Small Open Economy Extension (IRBC)

Macro II - Fluctuations - ENSAE, 2024-2025

Introduction and Basic Facts

Why a small open economy?

What are the classical reasons to open economy to trade?

- trade integration

- taste for variety

- comparative advantage

- financial integration

- smooth shock / insurance

From RBC to IRBC

RBC models have been very successful at matching Business Cycles

- (temporary) victory against keynesian view that short term fluctuations result from demand shocks

- so successful that facts at odd with theoretical predictions have been called “puzzles”

. . .

It didn’t take long before the same methodology was applied to International Business Cycles

. . .

Seminal Paper:

- International Real Business Cycles, Backus, Kehoe, Kydland (1992) (freshwater economists)

Very successful methodology:

- facts at odd with theoretical predictions have been called “puzzles”

IRBC Facts

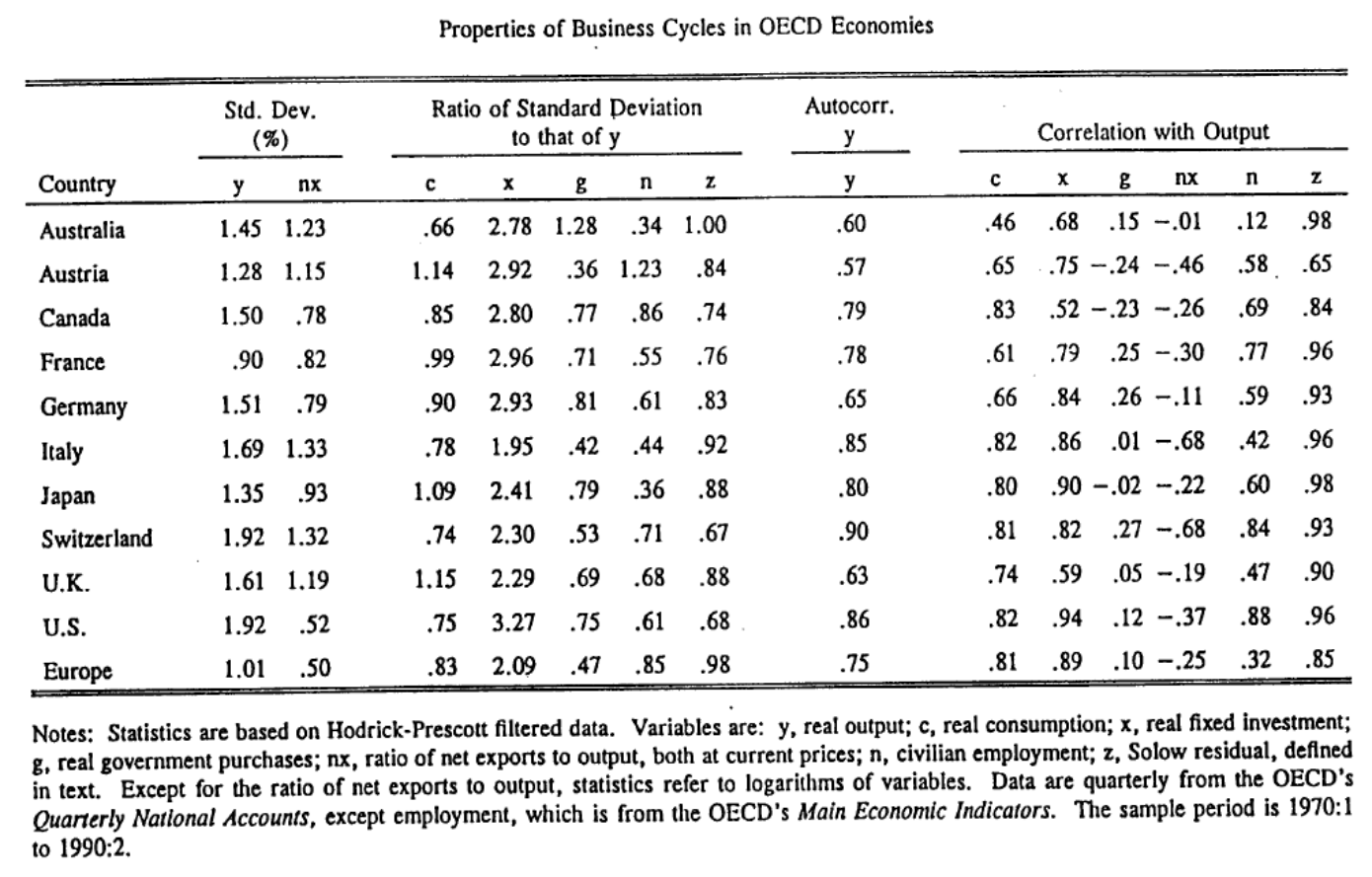

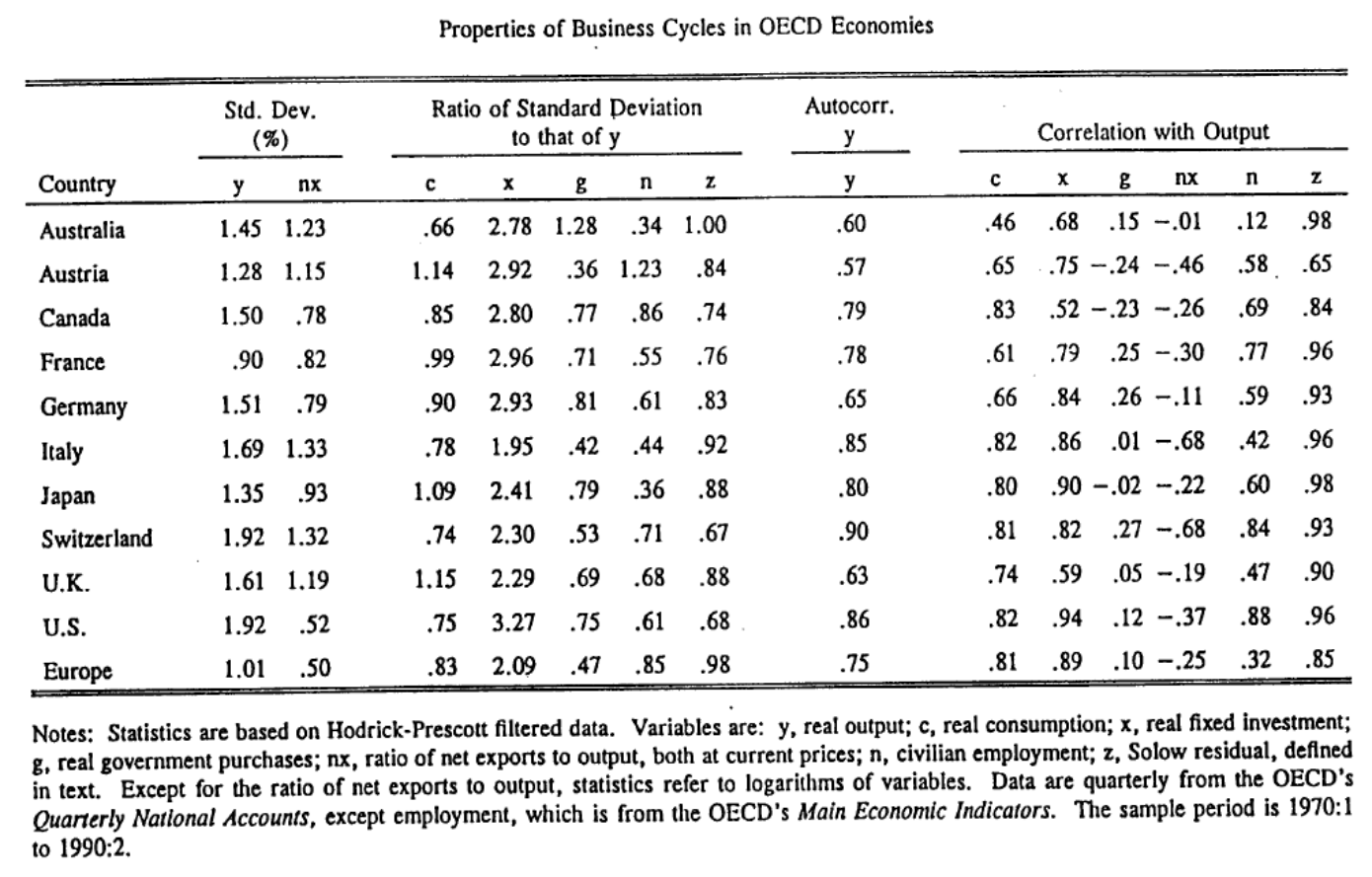

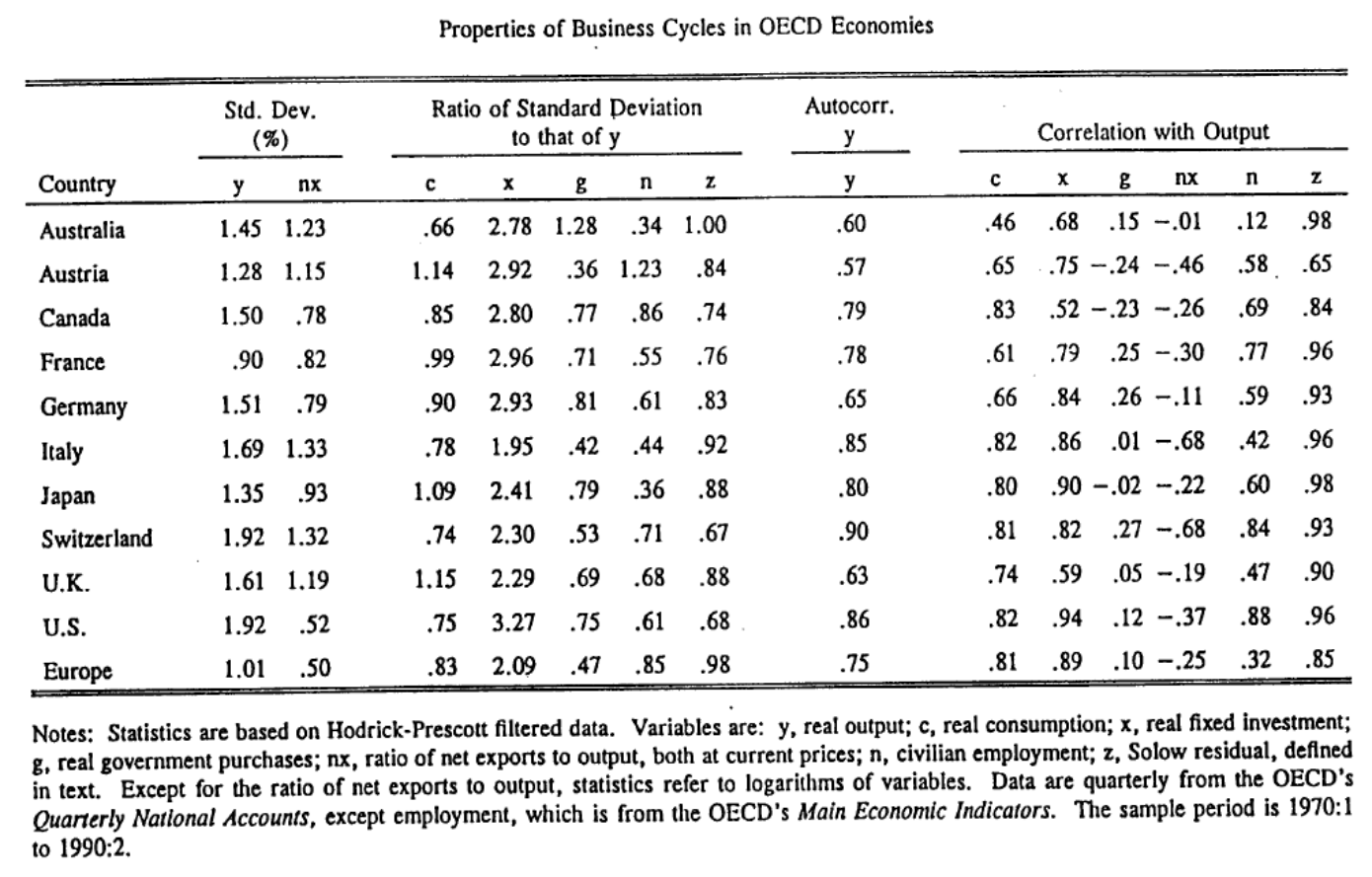

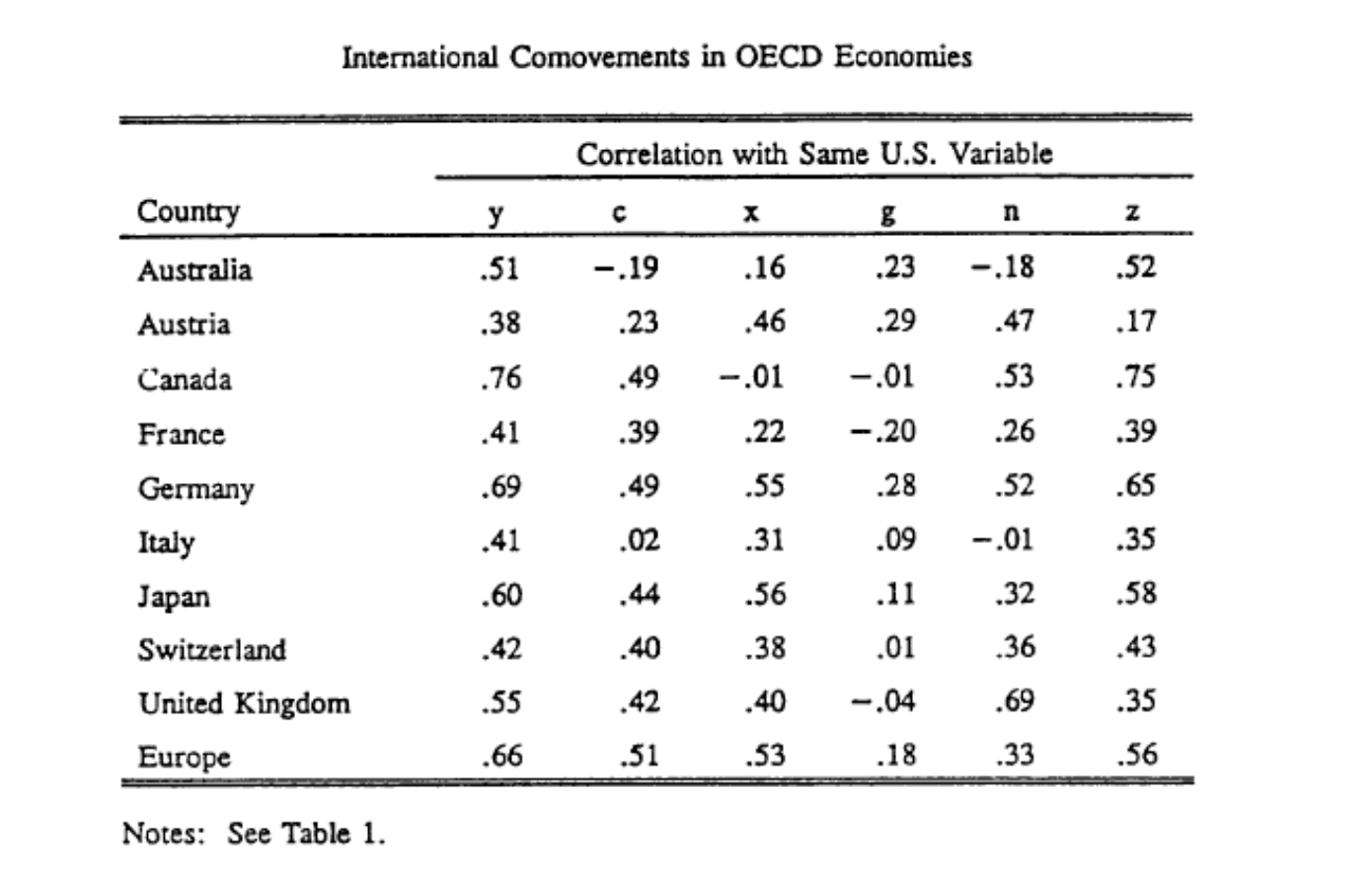

From Kehoe,Kydland (1995)

IRBC Facts

Stylized Facts

Domestically:

- output more variable than consumption

- output autocorrelated

- productivity strongly procyclical

- trade balance strongly countercyclcal

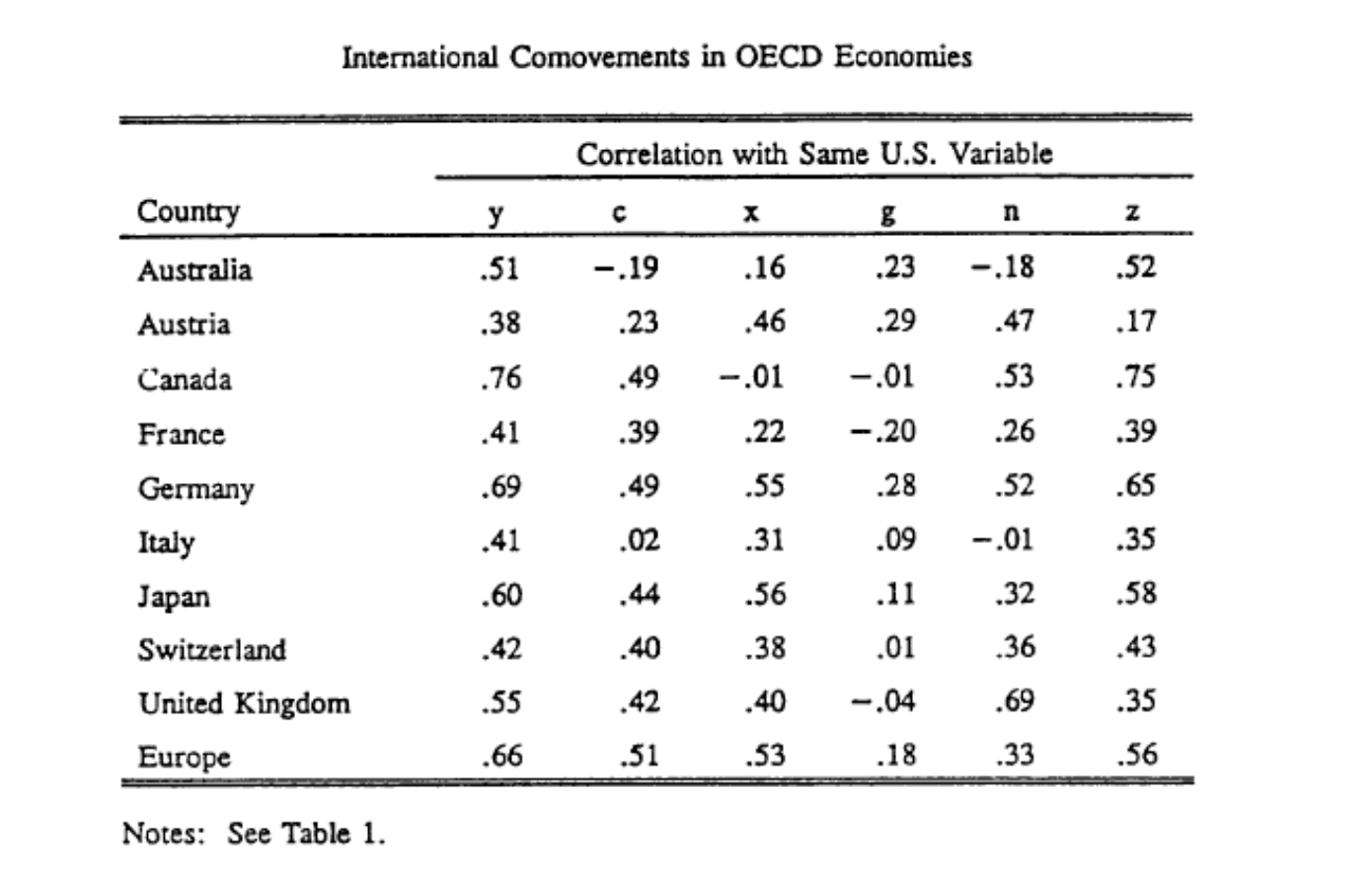

- positive comovements in output

Internationally:

- smaller comovements in consumption

- Backus-Kehoe-Kydland puzzle

. . .

Can we replicate these moments with a BC model?

Modeling a Small Open Economy

Endowment model

Representative agents maximizes: \[\max_{c_t} \sum_{t=0}^{\infty} \beta^t u(c_t)\] \[c_t + a_{t} \leq y_t + (1+r) a_{t-1} \]

Endowment economy:

- income \((y_t)_t\) is exogenously given

- for simplicity we assume it is deterministic

Small open economy:

- open: can save \(a_t\) which yields \(a_{t+1}(1+r)\) in the next period

- small: country takes world interest rate \(r\) as given (no effect on world prices)

We solve this problem with the terminal conditions:

\(a_{-1}\) given1

\(\lim_{T\rightarrow\infty} \frac{a_{T}}{(1+r)^T}\geq0\)

- no-ponzi condition

The no-ponzi condition will in effect eliminate diverging solutions.

In a first order approximation, it selects the right eigenvalues.

Endowment model (3)

We get the lagrangian:

\[\mathcal{L}= \sum_{t=0}^{\infty} \beta^t u(c_t) + \sum_{t=0}^{\infty} \beta^t \lambda_t \left(y_t + (1+r) a_{t-1} - c_t-a_{t} \right)\]

First order conditions:

\[\begin{align} u^{\prime}(c_t)& =& \lambda_t \\ \lambda_t &=& \beta (1+r) \lambda_{t+1} \end{align}\]

Under the technical assumption \(\beta (1+r)=1\) we get \(c_t=c_{t+1}\) then

\[c_0 = \frac{r}{1+r}\left\{ (1+r) a_{-1} + \sum_{t=0}^{\infty} \frac{y_t}{(1+r)^t}\right\}\]

. . .

- consumption is determined by permanent income

- changes in initial wealth have permanent effects

- remark: problem isomorphic to consumption-savings decisions

Current Account

The trade balance is exports-imports (here \(y_t-c_t\))

The current account is trade balance + net factor payments (here \(y_t-c_t+r a_{t-1}\))

Positive current account: additional lending to the rest of the world.

. . .

Using the formula from before

\[CA_0 = a_{-1} r + (1-\frac{r}{1+r}) y_0 - \frac{r}{1+r}\left\{ \sum_{t\geq1}^{\infty} \frac{y_t}{(1+r)^t}\right\}\]

How does the current account reacts to income shocks?

current account responds positively to temporary shock in income

and to news about future income shocks:

- This is the intertemporal approach to the current account

Unit root

Still with the same formula: \[c_0 = \frac{r}{1+r}\left\{ (1+r) a_{-1} + \sum_{t=0}^{\infty} \frac{y_t}{(1+r)^t}\right\}\]

What is the effect of an increase in \(a_{-1}\)?

- consumption rises permanently

- $a_t$ is constant, equal to $a_{-1}$

- agent consumes small amount $r$ corresponding to interests paid forever on $a_{-1}$- this will correspond to a unit root in the solution

Adding capital

We add capital and production to our endowment economy: \[y_t = z_t k_{t-1}^\alpha\] \[k_t = (1-\delta) k_{t-1} + i_{t}\]

The aggregate resource constraint becomes:

\[a_{t} + c_t + i_t = (1+r) a_{t-1} + y_t\]

Now maximize \(\sum_t \beta^ t U(c_t)\)

. . .

We get first order conditions

\[\lambda_t = \beta \lambda_{t+1} (1+r)\] \[\lambda_t = \beta \lambda_{t+1}\left[ (1-\delta) + z_{t+1} f^{\prime}(k_{t}) \right]\]

where \(\lambda_t\) is lagrange multiplier associated to budget constraint.

Adding capital: optimality conditions

Since \(\lambda_t>0\) (constraint is always binding), we get:

\[(1-\delta) + z_{t+1} f^{\prime}(k_{t}) = 1+r\]

\[k_{t} = \left( \frac{r+\delta}{\alpha z_{t+1}}\right)^{\frac{1}{\alpha-1}}\]

and investment \[i_t = \left( \frac{r+\delta}{\alpha z_{t+1}}\right)^{\frac{1}{\alpha-1}}- (1-\delta)\left( \frac{r+\delta}{\alpha z_{t}}\right)^{\frac{1}{\alpha-1}}\]

. . .

Here investment is fully determined by productivity shocks

- too simple: no international dependence

Add friction to the investment

A possible solution: change the resource constraint such that adjusting capital is costly

For instance:

\[a_{t} + c_t + i_t + \frac{\omega}{2}\frac{(k_{t}-k_{t-1})^ 2}{k_t} = (1+r)a_{t-1} + z f(k_{t-1})\]

\[k_{t} = (1-\delta) k_{t-1} + i_t\]

where \(\omega\) is an adjustment friction.

. . .

Typically, \(\omega\) is chosen so that the model replicates \(\frac{Var(i_t)}{Var(y_t)}\) from the data.

. . .

🔜 Cf tutorial.

A benchmark Small Open Economy Model

A benchmark Small Open Economy Model

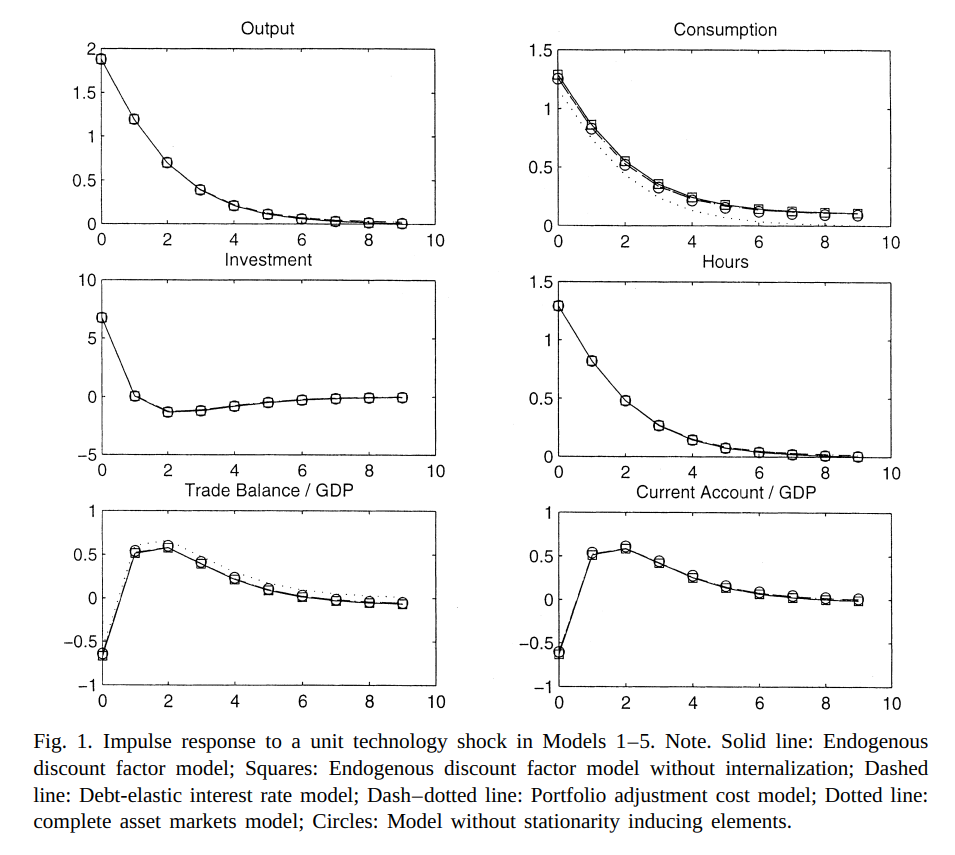

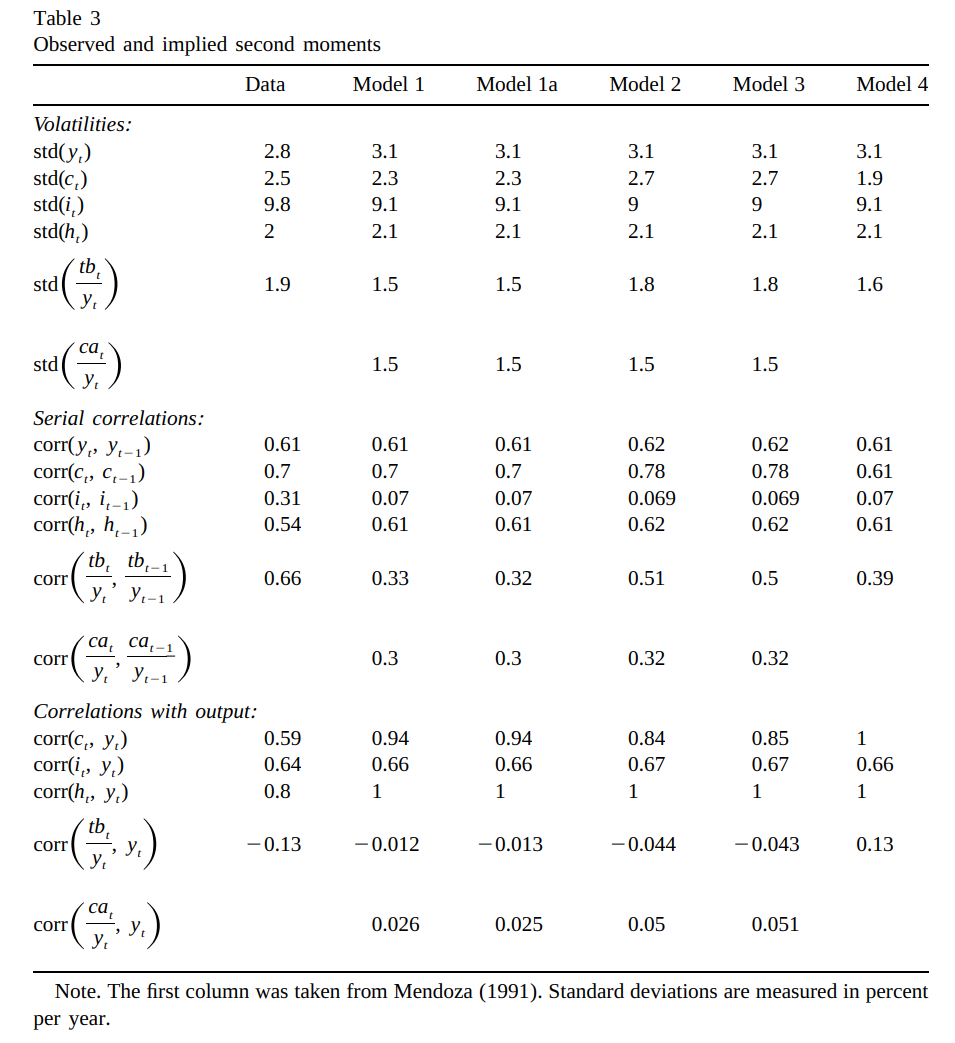

Closing Small Economy Models, Schmitt Grohe and Uribe (2003), JIE

- small open economy model with production, consumption-leisure tradeoff and capital adjustment costs

- = RBC+open+adj costs

- perform some moments matching

- compare different ways of stationarizing

The model

\[\max_{c_t, n_t} \sum_{t=0}^{\infty} \beta^t u(c_t, n_t)\]

\[c_t + k_{t} + a_{t} = y_t + g_t - \frac{\omega}{2}(k_{t}-k_{t-1})^2 +(1-\delta) k_{t-1} + (1+r^{\star}+{\color{red}\pi(a_{t-1})})a_{t-1}\] \[y_t = f(k_{t-1}, n_t, z_t)\]

\[z_{t+1} = \rho z_t + \epsilon_{t+1}\]

and \[u(c, n) = \frac{1}{1-\sigma}\left(c^{\psi}(1-n)^{1-\psi} )\right)^{1-\sigma}\]

. . .

The term \(\color{red}\pi\) is there to make the model stationary.

How to make the distribution stationary?

The solution of the model exhibits a unit root:

\[a_t = a_{t-1} + ... \text{other variables in t-1} + \text{shocks in t}\]

. . .

Problem:

- there isn’t a unique deterministic steady-state

- the ergodic distribution of the model variables is not defined

This raises practical issues (notably for estimation) for the linear model.

- no unconditional moments

How to get rid of the unit root?

General idea:

- introduce a force that pulls the level of foreign assets towards equilibrium

Schmitt Grohe and Uribe (2003) consider many options:

- debt-elastic interest rate: \[1+r = 1+r^{\star} + \pi(a_d)\]

- with \(\pi(0)=0\) and \(\pi^{\prime}(0)>0\)

- \(\pi\) can be understood as a risk premium on rising debt

- endogenous time-discount (aka Usawa preferences) \[\beta(c_t) = (1+c_t)^{-\chi}\]

- costs of adjustment for international portfolios

. . .

SGU show that the choice of the stationarization device has little effect for the dynamics (moments) of most variables

Calibration

| Parameters | Values |

|---|---|

| \(σ\) | 2 |

| \(ψ\) | 1.45 |

| \(α\) | 0.32 |

| \(ω\) | 0.028 |

| \(r\) | 0.04 |

| Parameters | Values |

|---|---|

| \(δ\) | 0.1 |

| \(ρ\) | 0.42 |

| \(σ²\) | 0.0129 |

| \(A^{\star}\) | -0.7442 |

| \(χ\) | 0.000742 |

Results

Conclusions

- The model matches unconditional correlations fairly well

- The stationarization device has little effect on the moments

- Unconditional correlations are not that great

- a limitation of the moment matching method?

- Correlation of consumption with output is too high

- and probably cross-correlation of consumption too low

- still the Backus-Kehoe-Kydland puzzle…

Footnotes

Note that initial condition is compatible with the dynare conventions we use here.↩︎