# uncomment the next lines, the first time you run

# import Pkg; Pkg.add(["DBnomics", "Dynare", "DataFrames"])Opening Economy Extension

Business Cycles and Fluctuations - AE2E6

- Modify a modfile with a model extension.

- Compare model solutions for different parameterizations.

Uncomment the following lines to install needed packages (if not already present).

Small Open Economy

Start from the same rbc model. Assume the representative agent can save \(b^{\star}_t\) as foreign assets, remunerated at a constant interest rate \(r^{\star}-1\).

Write the new budget constraint for the representative household.

At given date t, the household saves \(b^{\star}_t\) in the foreigh country and receives repayment \(b^{\star}_{t-1}\) plus interests \((r^{\star} − 1)b^{\star}_{t-1}\) . Starting from the RBC constraint, the new constraint becomes: \[c_t + i_t + b^ {\star}_t \leq w_t n_t + r_t k_{t-1} + r^ {\star} b^{\star}_{t-1}\]

and the lagrangian is:

\[\mathcal{L} = E_t \sum_{j=0}^\infty \beta^j\left[\log c_{t+j} + \chi \dfrac{(1-n_{t+j})^{1-\eta}}{1-\eta} \right.\]

\[+\lambda_{t+j} (w_{t+j}n_{t+j} + r_{t+j}k_{t+j-1} - c_{t+j}-k_{t+j} + (1-\delta)k_{t+j-1} + r^* b^*_{t+j-1} - b^*_{t+j} )\Bigg]\]

Write the new optimality condition.

We must add the optimality condition relative to \(b^{\star}_t\) : the representative household chooses amount of savings to maximise its intertemporal utility of consumption. We find :

\[ -\lambda_t + \beta E_t[\lambda_{t+1}r^*]=0\] or : \[ \frac{1}{c_t}=\beta r^* E_t\left[\frac{1}{c_{t+1}} \right]\]

What is the long run constraint on interest rate \(r^{\star}\)?

In the deterministic steady-state the euler equation implies \(r^{\star}= \frac{1}{\beta}\) . In principle \(r^{\star}\) is a a foreign interest rate determined by factors external to the country. Yet \(\frac{1}{\beta}\) is the only value it can take that is compatible with the existence of a long run steady-state. This can be interpreted as an arbitrage condition: \(\frac{1}{\beta}\) is the domestic intesrest rate. If it was lower/higher than world interest rate, there would be infinite capital flows from/to the country.

(in a deterministic setting the arbitrage principle implies that all investment opportunities must yield the same return)

Update the modfile (set \(\overline{b^{\star}}=0\))

To update the modfile, one must declare a new variable \(b^{\star}\) and the new parameter \(r^\star\). The latter is set to \(\frac{1}{\beta}\) . One must also add the above optimality condition and update the equation characterizing the equilibrium on the goods markets. That one comes from the budget constraint. Rewriting the budget constraint for a small open economy we have:

\[c_t + i_t + b^{\star}_t = w_t n_t + r_t k_{t-1} + r^{\star} b^{\star}_{t-1}\]

Since we assume competitive markets, the firm doesn’t do any profit. We have \(y_t = w_t n_t + r_t k_{t−1}\) and:

\[c_t + i_t + b^{\star}_t - r^{\star} b^{\star}_{t-1} = y_t\]

Next, we can observe that the static model doesn’t pin down the steady-state level of \(b^{\star}\) ; we set it to 0, so that the steady-state values of all other variables ar unchanged. We thus add \(b^{\star}=0\) in the steady_state_model; block.

using Dynare

context = @dynare "rbc_open.mod";

# saving the result in context is useful for future comparisonDynare version: 0.9.18

2025-04-16T13:55:54.314: Starting @dynare rbc_open.mod

["rbc_open.mod", "language=julia", "json=compute"]

Dynare preprocessor version: 6.4.0+0

2025-04-16T13:55:54.388: End of preprocessingStarting preprocessing of the model file ...

Found 9 equation(s).

Evaluating expressions...

Computing static model derivatives (order 1).

Normalizing the static model...

Finding the optimal block decomposition of the static model...

6 block(s) found:

5 recursive block(s) and 1 simultaneous block(s).

the largest simultaneous block has 4 equation(s)

and 2 feedback variable(s).

Computing dynamic model derivatives (order 1).

Normalizing the dynamic model...

Normalization failed with cutoff, trying symbolic normalization...

Could not normalize the dynamic model. Variable i is not in the maximum cardinality matching.

JSON written after Computing step.

Preprocessing completed.

2025-04-16T13:55:54.427: Start parse_statements!

Coefficients of approximate solution function (reduced form)

───────────┬─────────────────────────────────────────────────────────────────────────────

│ y_t i_t c_t n_t a_t b_t k_t r_t w_t

─────────────────────────────────────────────────────────────────────────────────────────

ϕ(a) │ 1.2438 21.1617 0.2685 0.231 0.95 -20.1864 21.1617 0.0644 1.2796

ϕ(b) │ -0.0077 -0.1389 0.0077 -0.0043 0.0 1.1439 -0.1389 -0.0004 0.0077

ϕ(k) │ 0.0744 -1.1189 0.008 0.0163 0.0 1.1854 -0.1439 -0.0033 0.0632

epsilon_t │ 1.3092 22.2754 0.2826 0.2431 1.0 -21.2488 22.2754 0.0678 1.347

───────────┴─────────────────────────────────────────────────────────────────────────────

Note: ϕ(x) = x_{t-1} - steady_state(x)

THEORETICAL MOMENTS

──────────┬─────────────────────────────

VARIABLE │ MEAN STD. DEV. VARIANCE

────────────────────────────────────────

y │ NaN NaN NaN

i │ NaN NaN NaN

c │ NaN NaN NaN

n │ NaN NaN NaN

a │ 1.0 0.0288 0.0008

b │ NaN NaN NaN

k │ NaN NaN NaN

r │ 0.0454 0.002 0.0

w │ 1.7797 0.0388 0.0015

──────────┴─────────────────────────────

VARIANCE DECOMPOSITION (in percent)

──────────┬─────────

VARIABLE │ epsilon

────────────────────

a │ 1.0

r │ 1.0

w │ 1.0

──────────┴─────────

CORRELATION MATRIX

───┬───────────────

│ a r w

───────────────────

a │ 1.0 1.0 1.0

r │ 1.0 1.0 1.0

w │ 1.0 1.0 1.0

───┴───────────────

AUTOCORRELATION COEFFICIENTS

───┬──────────────────────────────────────

│ 1 2 3 4 5

──────────────────────────────────────────

a │ 0.95 0.9025 0.8574 0.8145 0.7738

r │ 0.95 0.9025 0.8574 0.8145 0.7738

w │ 0.95 0.9025 0.8574 0.8145 0.7738

───┴──────────────────────────────────────

2025-04-16T13:55:56.160: End parse_statements!

2025-04-16T13:55:56.160: End parserlongname: c

texname: c

symboltype: Endogenous

orderintype: 3

longname: b

texname: b

symboltype: Endogenous

orderintype: 6

longname: r

texname: r

symboltype: Endogenous

orderintype: 8

longname: khi

texname: khi

symboltype: Parameter

orderintype: 5

longname: a

texname: a

symboltype: Endogenous

orderintype: 5

longname: nss

texname: nss

symboltype: Parameter

orderintype: 4

longname: bet

texname: bet

symboltype: Parameter

orderintype: 1

longname: i

texname: i

symboltype: Endogenous

orderintype: 2

longname: y

texname: y

symboltype: Endogenous

orderintype: 1

longname: del

texname: del

symboltype: Parameter

orderintype: 2

endogenous_nbr: 9

exogenous_nbr: 1

lagged_exogenous_nbr: 0

exogenous_deterministic_nbr: 0

parameter_nbr: 8

original_endogenous_nbr: 9

lead_lag_incidence: [0 0 0 0 1 2 3 0 0; 4 5 6 7 8 9 10 11 12; 0 0 13 0 0 0 0 14 0]

n_static: 4

n_fwrd: 2

n_bkwrd: 3

n_both: 0

n_states: 3

DErows1: [1, 2, 3, 4, 5]

DErows2: Int64[]

n_dyn: 5

i_static: [1, 2, 4, 9]

i_dyn: [3, 5, 6, 7, 8]

i_bkwrd: [5, 6, 7]

i_bkwrd_b: [5, 6, 7]

i_bkwrd_ns: [2, 3, 4]

i_fwrd: [3, 8]

i_fwrd_b: [3, 8]

i_fwrd_ns: [1, 5]

i_both: Int64[]

i_non_states: [1, 2, 3, 4, 8, 9]

p_static: [4, 5, 7, 12]

p_bkwrd: [1, 2, 3]

p_bkwrd_b: [1, 2, 3]

p_fwrd: [13, 14]

p_fwrd_b: [13, 14]

p_both_b: Int64[]

p_both_f: Int64[]

i_current: [1, 2, 3, 4, 5, 6, 7, 8, 9]

p_current: [4, 5, 6, 7, 8, 9, 10, 11, 12]

n_current: 9

i_current_ns: [1, 2, 3, 4, 5]

p_current_ns: [6, 8, 9, 10, 11]

n_current_ns: 5

icolsD: [1, 2, 3, 4, 5]

jcolsD: [8, 9, 10, 13, 14]

icolsE: [1, 2, 3, 4, 5]

jcolsE: [1, 2, 3, 6, 11]

colsUD: Int64[]

colsUE: Int64[]

i_cur_fwrd: [1, 2]

n_cur_fwrd: 2

p_cur_fwrd: [6, 11]

i_cur_bkwrd: [1, 2, 3]

n_cur_bkwrd: 3

p_cur_bkwrd: [8, 9, 10]

i_cur_both: Int64[]

n_cur_both: 0

p_cur_both: Int64[]

gx_rows: [4, 5]

hx_rows: [1, 2, 3]

i_current_exogenous: [15]

i_lagged_exogenous: Int64[]

serially_correlated_exogenous: Int64[]

Sigma_e: [8.099999999999999e-5;;]

maximum_endo_lag: 1

maximum_endo_lead: 1

maximum_exo_lag: 0

maximum_exo_lead: 0

maximum_exo_det_lag: 0

maximum_exo_det_lead: 0

maximum_lag: 1

maximum_lead: 1

orig_maximum_endo_lag: 1

orig_maximum_endo_lead: 1

orig_maximum_exo_lag: 0

orig_maximum_exo_lead: 0

orig_maximum_exo_det_lag: 0

orig_maximum_exo_det_lead: 0

orig_maximum_lag: 1

orig_maximum_lead: 1

dynamic_indices: [3, 5, 6, 7, 8]

current_dynamic_indices: [3, 5, 6, 7, 8]

forward_indices_d: [1, 5]

backward_indices_d: [2, 3, 4]

current_dynamic_indices_d: [1, 2, 3, 4, 5]

exogenous_indices: [15]

NNZDerivatives: [29, -1, -1]

auxiliary_variables: Dict{String, Any}[]

mcps: Tuple{Int64, Int64, String, String}[]

dynamic_g1_sparse_rowval: [6, 9, 4, 5, 8, 5, 7, 8, 9, 4, 9, 1, 2, 3, 9, 3, 5, 7, 5, 6, 9, 4, 8, 3, 7, 1, 2, 1, 6]

dynamic_g1_sparse_colptr: [1, 1, 1, 1, 1, 2, 3, 6, 6, 6, 10, 12, 16, 19, 21, 22, 23, 24, 26, 26, 26, 28, 28, 28, 28, 28, 29, 29, 30]

dynamic_g2_sparse_indices: Vector{Int64}[]

static_g1_sparse_rowval: [5, 7, 8, 9, 4, 9, 1, 2, 3, 9, 3, 5, 7, 5, 6, 9, 4, 5, 8, 1, 8, 3, 7]

static_g1_sparse_colptr: [1, 5, 7, 11, 14, 16, 17, 20, 22, 24]

dynamic_tmp_nbr: [4, 0, 0, 0]

static_tmp_nbr: [4, 0, 0, 0]

ids: LinearRationalExpectations.Indices([1, 2, 3, 4, 5, 6, 7, 8, 9], [3, 8], [3, 8], [5, 6, 7], Int64[], [1, 2, 3, 4, 8, 9], [1, 2, 4, 9], [3, 5, 6, 7, 8], [3, 5, 6, 7, 8], [1, 2, 3, 4, 5], [1, 5], [2, 3, 4], [6, 8, 9, 10, 11], [4, 5, 7, 12], [15], 9, (D = [1, 2, 3, 4, 5], jacobian = [8, 9, 10, 13, 14]), (E = [1, 2, 3, 4, 5], jacobian = [1, 2, 3, 6, 11]), Int64[], Int64[])

endval_is_reset: false

has_auxiliary_variables: false

has_calib_smoother: false

has_check: true

has_deterministic_trend: false

has_dynamic_file: true

has_endval: false

has_histval: false

has_histval_file: false

has_initval: false

has_initval_file: false

has_planner_objective: false

has_perfect_foresight_setup: false

has_perfect_foresight_solver: false

has_ramsey_model: false

has_shocks: true

has_static_file: true

has_steadystate_file: true

has_stoch_simul: true

has_trends: false

initval_is_reset: false

modfilepath: rbc_open

irfs: Dict{Symbol, AxisArrayTables.AxisArrayTable}(:epsilon => ┌─────┬──────────────┬─────────────┬───────────┬──────────────┬─────────────┬─────────────┬──────────────┬──────────────┬─────────────┐

│ │ y │ i │ c │ n │ a │ b │ k │ r │ w │

├─────┼──────────────┼─────────────┼───────────┼──────────────┼─────────────┼─────────────┼──────────────┼──────────────┼─────────────┤

│ 1 │ 0.0117832 │ 0.200479 │ 0.0025434 │ 0.0021882 │ 0.009 │ -0.191239 │ 0.200479 │ 0.000610409 │ 0.0121227 │

│ 2 │ 0.027586 │ -0.00730498 │ 0.0025434 │ 0.00617429 │ 0.00855 │ -0.162794 │ 0.188162 │ -4.32055e-17 │ 0.0227106 │

│ 3 │ 0.0258912 │ -0.00699705 │ 0.0025434 │ 0.00574679 │ 0.0081225 │ -0.135772 │ 0.176461 │ 5.73272e-18 │ 0.021575 │

│ 4 │ 0.0242811 │ -0.00670452 │ 0.0025434 │ 0.00534067 │ 0.00771638 │ -0.110101 │ 0.165345 │ 5.52265e-18 │ 0.0204963 │

│ 5 │ 0.0227515 │ -0.00642662 │ 0.0025434 │ 0.00495485 │ 0.00733056 │ -0.0857127 │ 0.154785 │ 5.30581e-18 │ 0.0194715 │

│ 6 │ 0.0212984 │ -0.00616262 │ 0.0025434 │ 0.00458832 │ 0.00696403 │ -0.0625443 │ 0.144752 │ 5.14996e-18 │ 0.0184979 │

│ 7 │ 0.019918 │ -0.00591181 │ 0.0025434 │ 0.00424012 │ 0.00661583 │ -0.0405343 │ 0.135222 │ 5.03138e-18 │ 0.017573 │

│ 8 │ 0.0186066 │ -0.00567355 │ 0.0025434 │ 0.00390933 │ 0.00628504 │ -0.0196248 │ 0.126168 │ 4.80776e-18 │ 0.0166944 │

│ 9 │ 0.0173607 │ -0.00544719 │ 0.0025434 │ 0.00359508 │ 0.00597078 │ 0.000239224 │ 0.117566 │ 4.76541e-18 │ 0.0158596 │

│ 10 │ 0.0161772 │ -0.00523216 │ 0.0025434 │ 0.00329654 │ 0.00567224 │ 0.01911 │ 0.109395 │ 4.63301e-18 │ 0.0150667 │

│ 11 │ 0.0150528 │ -0.00502788 │ 0.0025434 │ 0.00301293 │ 0.00538863 │ 0.0370373 │ 0.101632 │ 4.46132e-18 │ 0.0143133 │

│ 12 │ 0.0139846 │ -0.00483381 │ 0.0025434 │ 0.0027435 │ 0.0051192 │ 0.0540682 │ 0.0942576 │ 4.38255e-18 │ 0.0135977 │

│ 13 │ 0.0129699 │ -0.00464944 │ 0.0025434 │ 0.00248754 │ 0.00486324 │ 0.0702476 │ 0.0872517 │ 4.25549e-18 │ 0.0129178 │

│ 14 │ 0.0120059 │ -0.00447429 │ 0.0025434 │ 0.00224437 │ 0.00462008 │ 0.085618 │ 0.0805961 │ 4.21145e-18 │ 0.0122719 │

│ 15 │ 0.0110901 │ -0.0043079 │ 0.0025434 │ 0.00201337 │ 0.00438907 │ 0.10022 │ 0.0742733 │ 4.01155e-18 │ 0.0116583 │

│ 16 │ 0.01022 │ -0.00414983 │ 0.0025434 │ 0.00179392 │ 0.00416962 │ 0.114092 │ 0.0682666 │ 3.94379e-18 │ 0.0110754 │

│ 17 │ 0.00939352 │ -0.00399967 │ 0.0025434 │ 0.00158543 │ 0.00396114 │ 0.12727 │ 0.0625603 │ 3.89635e-18 │ 0.0105216 │

│ 18 │ 0.00860833 │ -0.00385701 │ 0.0025434 │ 0.00138738 │ 0.00376308 │ 0.139789 │ 0.0571393 │ 3.75405e-18 │ 0.00999552 │

│ 19 │ 0.00786239 │ -0.00372148 │ 0.0025434 │ 0.00119922 │ 0.00357493 │ 0.151682 │ 0.0519893 │ 3.70662e-18 │ 0.00949575 │

│ 20 │ 0.00715376 │ -0.00359274 │ 0.0025434 │ 0.00102048 │ 0.00339618 │ 0.162981 │ 0.0470969 │ 3.61175e-18 │ 0.00902096 │

│ 21 │ 0.00648055 │ -0.00347042 │ 0.0025434 │ 0.000850668 │ 0.00322637 │ 0.173715 │ 0.042449 │ 3.59142e-18 │ 0.00856991 │

│ 22 │ 0.00584101 │ -0.00335423 │ 0.0025434 │ 0.000689349 │ 0.00306505 │ 0.183912 │ 0.0380336 │ 3.5101e-18 │ 0.00814142 │

│ 23 │ 0.00523344 │ -0.00324384 │ 0.0025434 │ 0.000536096 │ 0.0029118 │ 0.193599 │ 0.0338389 │ 3.44234e-18 │ 0.00773435 │

│ 24 │ 0.00465625 │ -0.00313897 │ 0.0025434 │ 0.000390506 │ 0.00276621 │ 0.202802 │ 0.0298539 │ 3.40168e-18 │ 0.00734763 │

│ 25 │ 0.00410792 │ -0.00303935 │ 0.0025434 │ 0.000252196 │ 0.0026279 │ 0.211545 │ 0.0260682 │ 3.33392e-18 │ 0.00698025 │

│ 26 │ 0.003587 │ -0.00294471 │ 0.0025434 │ 0.000120801 │ 0.00249651 │ 0.21985 │ 0.0224718 │ 3.27971e-18 │ 0.00663124 │

│ 27 │ 0.00309213 │ -0.0028548 │ 0.0025434 │ -4.02471e-6 │ 0.00237168 │ 0.22774 │ 0.0190552 │ 3.21195e-18 │ 0.00629967 │

│ 28 │ 0.00262201 │ -0.00276938 │ 0.0025434 │ -0.000122609 │ 0.0022531 │ 0.235236 │ 0.0158095 │ 3.18484e-18 │ 0.00598469 │

│ 29 │ 0.00217539 │ -0.00268824 │ 0.0025434 │ -0.000235264 │ 0.00214044 │ 0.242357 │ 0.012726 │ 3.15774e-18 │ 0.00568546 │

│ 30 │ 0.0017511 │ -0.00261115 │ 0.0025434 │ -0.000342286 │ 0.00203342 │ 0.249122 │ 0.00979669 │ 3.08998e-18 │ 0.00540118 │

│ 31 │ 0.00134803 │ -0.00253792 │ 0.0025434 │ -0.000443957 │ 0.00193175 │ 0.255549 │ 0.00701385 │ 3.00866e-18 │ 0.00513112 │

│ 32 │ 0.00096511 │ -0.00246835 │ 0.0025434 │ -0.000540544 │ 0.00183516 │ 0.261654 │ 0.00437016 │ 2.98156e-18 │ 0.00487457 │

│ 33 │ 0.000601336 │ -0.00240226 │ 0.0025434 │ -0.000632302 │ 0.0017434 │ 0.267454 │ 0.00185865 │ 2.968e-18 │ 0.00463084 │

│ 34 │ 0.000255751 │ -0.00233947 │ 0.0025434 │ -0.000719472 │ 0.00165623 │ 0.272964 │ -0.000527286 │ 2.91379e-18 │ 0.0043993 │

│ 35 │ -7.25548e-5 │ -0.00227982 │ 0.0025434 │ -0.000802284 │ 0.00157342 │ 0.278199 │ -0.00279392 │ 2.90024e-18 │ 0.00417933 │

│ 36 │ -0.000384445 │ -0.00222315 │ 0.0025434 │ -0.000880955 │ 0.00149475 │ 0.283172 │ -0.00494723 │ 2.84603e-18 │ 0.00397037 │

│ 37 │ -0.000680741 │ -0.00216932 │ 0.0025434 │ -0.000955693 │ 0.00142001 │ 0.287896 │ -0.00699287 │ 2.84603e-18 │ 0.00377185 │

│ 38 │ -0.000962222 │ -0.00211818 │ 0.0025434 │ -0.00102669 │ 0.00134901 │ 0.292384 │ -0.00893623 │ 2.79182e-18 │ 0.00358325 │

│ 39 │ -0.00122963 │ -0.0020696 │ 0.0025434 │ -0.00109414 │ 0.00128156 │ 0.296647 │ -0.0107824 │ 2.76472e-18 │ 0.00340409 │

│ 40 │ -0.00148367 │ -0.00202344 │ 0.0025434 │ -0.00115822 │ 0.00121748 │ 0.300698 │ -0.0125363 │ 2.73761e-18 │ 0.00323389 │

│ 41 │ -0.001725 │ -0.00197959 │ 0.0025434 │ -0.0012191 │ 0.00115661 │ 0.304546 │ -0.0142025 │ 2.71051e-18 │ 0.00307219 │

│ 42 │ -0.00195427 │ -0.00193794 │ 0.0025434 │ -0.00127693 │ 0.00109878 │ 0.308201 │ -0.0157854 │ 2.6834e-18 │ 0.00291858 │

│ 43 │ -0.00217207 │ -0.00189837 │ 0.0025434 │ -0.00133187 │ 0.00104384 │ 0.311674 │ -0.0172891 │ 2.6563e-18 │ 0.00277265 │

│ 44 │ -0.00237899 │ -0.00186077 │ 0.0025434 │ -0.00138406 │ 0.000991648 │ 0.314973 │ -0.0187176 │ 2.60209e-18 │ 0.00263402 │

│ 45 │ -0.00257556 │ -0.00182506 │ 0.0025434 │ -0.00143364 │ 0.000942066 │ 0.318107 │ -0.0200748 │ 2.60209e-18 │ 0.00250232 │

│ 46 │ -0.0027623 │ -0.00179113 │ 0.0025434 │ -0.00148074 │ 0.000894962 │ 0.321085 │ -0.021364 │ 2.54788e-18 │ 0.0023772 │

│ 47 │ -0.0029397 │ -0.0017589 │ 0.0025434 │ -0.00152549 │ 0.000850214 │ 0.323913 │ -0.0225888 │ 2.57498e-18 │ 0.00225834 │

│ 48 │ -0.00310823 │ -0.00172828 │ 0.0025434 │ -0.001568 │ 0.000807703 │ 0.3266 │ -0.0237524 │ 2.54788e-18 │ 0.00214543 │

│ 49 │ -0.00326834 │ -0.00169919 │ 0.0025434 │ -0.00160839 │ 0.000767318 │ 0.329153 │ -0.0248578 │ 2.54788e-18 │ 0.00203816 │

│ 50 │ -0.00342044 │ -0.00167156 │ 0.0025434 │ -0.00164675 │ 0.000728952 │ 0.331578 │ -0.0259079 │ 2.54788e-18 │ 0.00193625 │

│ 51 │ -0.00356494 │ -0.0016453 │ 0.0025434 │ -0.0016832 │ 0.000692505 │ 0.333882 │ -0.0269055 │ 2.49366e-18 │ 0.00183944 │

│ 52 │ -0.00370221 │ -0.00162036 │ 0.0025434 │ -0.00171783 │ 0.00065788 │ 0.336071 │ -0.0278532 │ 2.46656e-18 │ 0.00174746 │

│ 53 │ -0.00383262 │ -0.00159667 │ 0.0025434 │ -0.00175072 │ 0.000624986 │ 0.33815 │ -0.0287536 │ 2.46656e-18 │ 0.00166009 │

│ 54 │ -0.0039565 │ -0.00157416 │ 0.0025434 │ -0.00178197 │ 0.000593736 │ 0.340125 │ -0.0296089 │ 2.43945e-18 │ 0.00157709 │

│ 55 │ -0.0040742 │ -0.00155278 │ 0.0025434 │ -0.00181166 │ 0.000564049 │ 0.342002 │ -0.0304214 │ 2.43945e-18 │ 0.00149823 │

│ 56 │ -0.00418601 │ -0.00153247 │ 0.0025434 │ -0.00183986 │ 0.000535847 │ 0.343784 │ -0.0311934 │ 2.46656e-18 │ 0.00142332 │

│ 57 │ -0.00429222 │ -0.00151317 │ 0.0025434 │ -0.00186665 │ 0.000509055 │ 0.345478 │ -0.0319267 │ 2.43945e-18 │ 0.00135215 │

│ 58 │ -0.00439313 │ -0.00149483 │ 0.0025434 │ -0.0018921 │ 0.000483602 │ 0.347087 │ -0.0326234 │ 2.43945e-18 │ 0.00128455 │

│ 59 │ -0.00448899 │ -0.00147742 │ 0.0025434 │ -0.00191628 │ 0.000459422 │ 0.348615 │ -0.0332852 │ 2.41235e-18 │ 0.00122032 │

│ 60 │ -0.00458006 │ -0.00146087 │ 0.0025434 │ -0.00193925 │ 0.000436451 │ 0.350067 │ -0.0339139 │ 2.41235e-18 │ 0.0011593 │

│ 61 │ -0.00466658 │ -0.00144515 │ 0.0025434 │ -0.00196108 │ 0.000414628 │ 0.351447 │ -0.0345113 │ 2.41235e-18 │ 0.00110134 │

│ 62 │ -0.00474877 │ -0.00143022 │ 0.0025434 │ -0.00198181 │ 0.000393897 │ 0.352757 │ -0.0350787 │ 2.38524e-18 │ 0.00104627 │

│ 63 │ -0.00482685 │ -0.00141603 │ 0.0025434 │ -0.0020015 │ 0.000374202 │ 0.354002 │ -0.0356178 │ 2.38524e-18 │ 0.000993958 │

│ 64 │ -0.00490102 │ -0.00140256 │ 0.0025434 │ -0.00202021 │ 0.000355492 │ 0.355185 │ -0.0361299 │ 2.38524e-18 │ 0.00094426 │

│ 65 │ -0.00497149 │ -0.00138976 │ 0.0025434 │ -0.00203799 │ 0.000337717 │ 0.356308 │ -0.0366164 │ 2.38524e-18 │ 0.000897047 │

│ 66 │ -0.00503843 │ -0.00137759 │ 0.0025434 │ -0.00205487 │ 0.000320831 │ 0.357376 │ -0.0370786 │ 2.33103e-18 │ 0.000852194 │

│ 67 │ -0.00510203 │ -0.00136604 │ 0.0025434 │ -0.00207092 │ 0.00030479 │ 0.35839 │ -0.0375176 │ 2.33103e-18 │ 0.000809585 │

│ 68 │ -0.00516245 │ -0.00135506 │ 0.0025434 │ -0.00208616 │ 0.00028955 │ 0.359353 │ -0.0379348 │ 2.35814e-18 │ 0.000769105 │

│ 69 │ -0.00521984 │ -0.00134463 │ 0.0025434 │ -0.00210063 │ 0.000275073 │ 0.360268 │ -0.038331 │ 2.33103e-18 │ 0.00073065 │

│ 70 │ -0.00527437 │ -0.00133473 │ 0.0025434 │ -0.00211439 │ 0.000261319 │ 0.361138 │ -0.0387075 │ 2.33103e-18 │ 0.000694118 │

│ 71 │ -0.00532617 │ -0.00132532 │ 0.0025434 │ -0.00212745 │ 0.000248253 │ 0.361963 │ -0.0390651 │ 2.30393e-18 │ 0.000659412 │

│ 72 │ -0.00537538 │ -0.00131637 │ 0.0025434 │ -0.00213987 │ 0.000235841 │ 0.362748 │ -0.0394048 │ 2.33103e-18 │ 0.000626441 │

│ 73 │ -0.00542213 │ -0.00130788 │ 0.0025434 │ -0.00215166 │ 0.000224049 │ 0.363493 │ -0.0397276 │ 2.33103e-18 │ 0.000595119 │

│ 74 │ -0.00546654 │ -0.00129981 │ 0.0025434 │ -0.00216286 │ 0.000212846 │ 0.364202 │ -0.0400342 │ 2.30393e-18 │ 0.000565363 │

│ 75 │ -0.00550873 │ -0.00129215 │ 0.0025434 │ -0.0021735 │ 0.000202204 │ 0.364874 │ -0.0403255 │ 2.30393e-18 │ 0.000537095 │

│ 76 │ -0.00554881 │ -0.00128486 │ 0.0025434 │ -0.00218361 │ 0.000192094 │ 0.365513 │ -0.0406022 │ 2.33103e-18 │ 0.00051024 │

│ 77 │ -0.00558689 │ -0.00127795 │ 0.0025434 │ -0.00219322 │ 0.000182489 │ 0.36612 │ -0.0408651 │ 2.27682e-18 │ 0.000484728 │

│ 78 │ -0.00562306 │ -0.00127137 │ 0.0025434 │ -0.00220234 │ 0.000173364 │ 0.366697 │ -0.0411149 │ 2.27682e-18 │ 0.000460492 │

│ 79 │ -0.00565743 │ -0.00126513 │ 0.0025434 │ -0.00221101 │ 0.000164696 │ 0.367245 │ -0.0413521 │ 2.30393e-18 │ 0.000437467 │

│ 80 │ -0.00569007 │ -0.0012592 │ 0.0025434 │ -0.00221924 │ 0.000156461 │ 0.367766 │ -0.0415775 │ 2.24972e-18 │ 0.000415594 │

│ 81 │ -0.00572109 │ -0.00125356 │ 0.0025434 │ -0.00222707 │ 0.000148638 │ 0.36826 │ -0.0417917 │ 2.27682e-18 │ 0.000394814 │

│ 82 │ -0.00575055 │ -0.00124821 │ 0.0025434 │ -0.0022345 │ 0.000141206 │ 0.36873 │ -0.0419951 │ 2.30393e-18 │ 0.000375073 │

│ 83 │ -0.00577854 │ -0.00124312 │ 0.0025434 │ -0.00224156 │ 0.000134146 │ 0.369176 │ -0.0421883 │ 2.27682e-18 │ 0.00035632 │

│ 84 │ -0.00580513 │ -0.00123829 │ 0.0025434 │ -0.00224827 │ 0.000127439 │ 0.3696 │ -0.0423719 │ 2.27682e-18 │ 0.000338504 │

│ 85 │ -0.0058304 │ -0.0012337 │ 0.0025434 │ -0.00225464 │ 0.000121067 │ 0.370003 │ -0.0425463 │ 2.24972e-18 │ 0.000321579 │

│ 86 │ -0.00585439 │ -0.00122934 │ 0.0025434 │ -0.00226069 │ 0.000115014 │ 0.370386 │ -0.042712 │ 2.27682e-18 │ 0.0003055 │

│ 87 │ -0.00587719 │ -0.0012252 │ 0.0025434 │ -0.00226644 │ 0.000109263 │ 0.370749 │ -0.0428694 │ 2.27682e-18 │ 0.000290225 │

│ 88 │ -0.00589885 │ -0.00122127 │ 0.0025434 │ -0.00227191 │ 0.0001038 │ 0.371094 │ -0.0430189 │ 2.24972e-18 │ 0.000275713 │

│ 89 │ -0.00591943 │ -0.00121753 │ 0.0025434 │ -0.0022771 │ 9.86097e-5 │ 0.371422 │ -0.043161 │ 2.22261e-18 │ 0.000261928 │

│ 90 │ -0.00593897 │ -0.00121398 │ 0.0025434 │ -0.00228203 │ 9.36792e-5 │ 0.371734 │ -0.0432959 │ 2.24972e-18 │ 0.000248831 │

│ 91 │ -0.00595754 │ -0.0012106 │ 0.0025434 │ -0.00228671 │ 8.89953e-5 │ 0.37203 │ -0.0434241 │ 2.24972e-18 │ 0.00023639 │

│ 92 │ -0.00597518 │ -0.0012074 │ 0.0025434 │ -0.00229116 │ 8.45455e-5 │ 0.372311 │ -0.0435459 │ 2.27682e-18 │ 0.00022457 │

│ 93 │ -0.00599194 │ -0.00120435 │ 0.0025434 │ -0.00229539 │ 8.03182e-5 │ 0.372579 │ -0.0436616 │ 2.24972e-18 │ 0.000213342 │

│ 94 │ -0.00600786 │ -0.00120146 │ 0.0025434 │ -0.0022994 │ 7.63023e-5 │ 0.372833 │ -0.0437716 │ 2.24972e-18 │ 0.000202675 │

│ 95 │ -0.00602299 │ -0.00119871 │ 0.0025434 │ -0.00230322 │ 7.24872e-5 │ 0.373074 │ -0.043876 │ 2.24972e-18 │ 0.000192541 │

│ 96 │ -0.00603736 │ -0.0011961 │ 0.0025434 │ -0.00230684 │ 6.88629e-5 │ 0.373303 │ -0.0439752 │ 2.27682e-18 │ 0.000182914 │

│ 97 │ -0.00605101 │ -0.00119362 │ 0.0025434 │ -0.00231029 │ 6.54197e-5 │ 0.37352 │ -0.0440694 │ 2.24972e-18 │ 0.000173768 │

│ 98 │ -0.00606398 │ -0.00119127 │ 0.0025434 │ -0.00231356 │ 6.21487e-5 │ 0.373727 │ -0.044159 │ 2.24972e-18 │ 0.00016508 │

│ 99 │ -0.0060763 │ -0.00118903 │ 0.0025434 │ -0.00231666 │ 5.90413e-5 │ 0.373924 │ -0.044244 │ 2.22261e-18 │ 0.000156826 │

│ 100 │ -0.006088 │ -0.0011869 │ 0.0025434 │ -0.00231962 │ 5.60892e-5 │ 0.37411 │ -0.0443248 │ 2.24972e-18 │ 0.000148985 │

│ 101 │ -0.00609912 │ -0.00118488 │ 0.0025434 │ -0.00232242 │ 5.32848e-5 │ 0.374287 │ -0.0444016 │ 2.22261e-18 │ 0.000141535 │

│ 102 │ -0.00610968 │ -0.00118296 │ 0.0025434 │ -0.00232509 │ 5.06205e-5 │ 0.374456 │ -0.0444745 │ 2.22261e-18 │ 0.000134459 │

│ 103 │ -0.00611971 │ -0.00118114 │ 0.0025434 │ -0.00232762 │ 4.80895e-5 │ 0.374616 │ -0.0445438 │ 2.24972e-18 │ 0.000127736 │

│ 104 │ -0.00612925 │ -0.00117941 │ 0.0025434 │ -0.00233002 │ 4.5685e-5 │ 0.374768 │ -0.0446096 │ 2.19551e-18 │ 0.000121349 │

│ 105 │ -0.0061383 │ -0.00117776 │ 0.0025434 │ -0.0023323 │ 4.34008e-5 │ 0.374912 │ -0.0446721 │ 2.24972e-18 │ 0.000115281 │

│ 106 │ -0.00614691 │ -0.0011762 │ 0.0025434 │ -0.00233447 │ 4.12307e-5 │ 0.375049 │ -0.0447315 │ 2.22261e-18 │ 0.000109517 │

│ 107 │ -0.00615508 │ -0.00117471 │ 0.0025434 │ -0.00233654 │ 3.91692e-5 │ 0.37518 │ -0.0447879 │ 2.22261e-18 │ 0.000104041 │

│ 108 │ -0.00616284 │ -0.0011733 │ 0.0025434 │ -0.00233849 │ 3.72107e-5 │ 0.375304 │ -0.0448415 │ 2.24972e-18 │ 9.88394e-5 │

│ 109 │ -0.00617022 │ -0.00117196 │ 0.0025434 │ -0.00234036 │ 3.53502e-5 │ 0.375421 │ -0.0448925 │ 2.22261e-18 │ 9.38974e-5 │

│ 110 │ -0.00617723 │ -0.00117069 │ 0.0025434 │ -0.00234212 │ 3.35827e-5 │ 0.375533 │ -0.0449408 │ 2.24972e-18 │ 8.92026e-5 │

│ 111 │ -0.00618388 │ -0.00116948 │ 0.0025434 │ -0.0023438 │ 3.19036e-5 │ 0.375639 │ -0.0449868 │ 2.22261e-18 │ 8.47424e-5 │

│ 112 │ -0.00619021 │ -0.00116833 │ 0.0025434 │ -0.0023454 │ 3.03084e-5 │ 0.37574 │ -0.0450305 │ 2.22261e-18 │ 8.05053e-5 │

│ 113 │ -0.00619621 │ -0.00116724 │ 0.0025434 │ -0.00234691 │ 2.8793e-5 │ 0.375836 │ -0.0450719 │ 2.22261e-18 │ 7.648e-5 │

│ 114 │ -0.00620192 │ -0.0011662 │ 0.0025434 │ -0.00234835 │ 2.73533e-5 │ 0.375927 │ -0.0451114 │ 2.19551e-18 │ 7.2656e-5 │

│ 115 │ -0.00620734 │ -0.00116522 │ 0.0025434 │ -0.00234972 │ 2.59856e-5 │ 0.376013 │ -0.0451488 │ 2.22261e-18 │ 6.90232e-5 │

│ 116 │ -0.0062125 │ -0.00116428 │ 0.0025434 │ -0.00235102 │ 2.46864e-5 │ 0.376095 │ -0.0451843 │ 2.22261e-18 │ 6.55721e-5 │

│ 117 │ -0.00621739 │ -0.00116339 │ 0.0025434 │ -0.00235225 │ 2.3452e-5 │ 0.376173 │ -0.0452181 │ 2.19551e-18 │ 6.22935e-5 │

│ 118 │ -0.00622204 │ -0.00116255 │ 0.0025434 │ -0.00235343 │ 2.22794e-5 │ 0.376247 │ -0.0452502 │ 2.24972e-18 │ 5.91788e-5 │

│ 119 │ -0.00622645 │ -0.00116175 │ 0.0025434 │ -0.00235454 │ 2.11655e-5 │ 0.376318 │ -0.0452807 │ 2.19551e-18 │ 5.62199e-5 │

│ 120 │ -0.00623065 │ -0.00116098 │ 0.0025434 │ -0.0023556 │ 2.01072e-5 │ 0.376385 │ -0.0453097 │ 2.22261e-18 │ 5.34089e-5 │

│ 121 │ -0.00623463 │ -0.00116026 │ 0.0025434 │ -0.0023566 │ 1.91018e-5 │ 0.376448 │ -0.0453372 │ 2.19551e-18 │ 5.07384e-5 │

│ 122 │ -0.00623842 │ -0.00115957 │ 0.0025434 │ -0.00235756 │ 1.81467e-5 │ 0.376509 │ -0.0453633 │ 2.22261e-18 │ 4.82015e-5 │

│ 123 │ -0.00624202 │ -0.00115892 │ 0.0025434 │ -0.00235847 │ 1.72394e-5 │ 0.376566 │ -0.0453882 │ 2.24972e-18 │ 4.57914e-5 │

│ 124 │ -0.00624544 │ -0.0011583 │ 0.0025434 │ -0.00235933 │ 1.63774e-5 │ 0.37662 │ -0.0454118 │ 2.22261e-18 │ 4.35019e-5 │

│ 125 │ -0.00624868 │ -0.00115771 │ 0.0025434 │ -0.00236015 │ 1.55586e-5 │ 0.376672 │ -0.0454342 │ 2.22261e-18 │ 4.13268e-5 │

│ 126 │ -0.00625177 │ -0.00115715 │ 0.0025434 │ -0.00236092 │ 1.47806e-5 │ 0.376721 │ -0.0454555 │ 2.24972e-18 │ 3.92604e-5 │

│ 127 │ -0.0062547 │ -0.00115661 │ 0.0025434 │ -0.00236166 │ 1.40416e-5 │ 0.376768 │ -0.0454757 │ 2.22261e-18 │ 3.72974e-5 │

│ 128 │ -0.00625748 │ -0.00115611 │ 0.0025434 │ -0.00236237 │ 1.33395e-5 │ 0.376812 │ -0.0454949 │ 2.19551e-18 │ 3.54325e-5 │

│ 129 │ -0.00626012 │ -0.00115563 │ 0.0025434 │ -0.00236303 │ 1.26725e-5 │ 0.376855 │ -0.0455132 │ 2.24972e-18 │ 3.36609e-5 │

│ 130 │ -0.00626264 │ -0.00115517 │ 0.0025434 │ -0.00236367 │ 1.20389e-5 │ 0.376895 │ -0.0455305 │ 2.19551e-18 │ 3.19779e-5 │

│ 131 │ -0.00626502 │ -0.00115474 │ 0.0025434 │ -0.00236427 │ 1.1437e-5 │ 0.376933 │ -0.045547 │ 2.22261e-18 │ 3.0379e-5 │

│ 132 │ -0.00626729 │ -0.00115433 │ 0.0025434 │ -0.00236484 │ 1.08651e-5 │ 0.376969 │ -0.0455626 │ 2.19551e-18 │ 2.886e-5 │

│ 133 │ -0.00626944 │ -0.00115394 │ 0.0025434 │ -0.00236538 │ 1.03219e-5 │ 0.377003 │ -0.0455775 │ 2.22261e-18 │ 2.7417e-5 │

│ 134 │ -0.00627149 │ -0.00115356 │ 0.0025434 │ -0.0023659 │ 9.80578e-6 │ 0.377036 │ -0.0455916 │ 2.22261e-18 │ 2.60462e-5 │

│ 135 │ -0.00627343 │ -0.00115321 │ 0.0025434 │ -0.00236639 │ 9.31549e-6 │ 0.377067 │ -0.0456051 │ 2.19551e-18 │ 2.47439e-5 │

│ 136 │ -0.00627528 │ -0.00115288 │ 0.0025434 │ -0.00236686 │ 8.84971e-6 │ 0.377096 │ -0.0456178 │ 2.24972e-18 │ 2.35067e-5 │

│ 137 │ -0.00627703 │ -0.00115256 │ 0.0025434 │ -0.0023673 │ 8.40723e-6 │ 0.377124 │ -0.0456299 │ 2.22261e-18 │ 2.23313e-5 │

│ 138 │ -0.0062787 │ -0.00115225 │ 0.0025434 │ -0.00236772 │ 7.98687e-6 │ 0.377151 │ -0.0456414 │ 2.22261e-18 │ 2.12148e-5 │

│ 139 │ -0.00628028 │ -0.00115197 │ 0.0025434 │ -0.00236812 │ 7.58752e-6 │ 0.377176 │ -0.0456524 │ 2.22261e-18 │ 2.0154e-5 │

│ 140 │ -0.00628179 │ -0.00115169 │ 0.0025434 │ -0.0023685 │ 7.20815e-6 │ 0.3772 │ -0.0456627 │ 2.19551e-18 │ 1.91463e-5 │

│ 141 │ -0.00628322 │ -0.00115143 │ 0.0025434 │ -0.00236886 │ 6.84774e-6 │ 0.377223 │ -0.0456726 │ 2.22261e-18 │ 1.8189e-5 │

│ 142 │ -0.00628457 │ -0.00115119 │ 0.0025434 │ -0.0023692 │ 6.50535e-6 │ 0.377244 │ -0.045682 │ 2.19551e-18 │ 1.72796e-5 │

│ 143 │ -0.00628586 │ -0.00115095 │ 0.0025434 │ -0.00236953 │ 6.18009e-6 │ 0.377265 │ -0.0456909 │ 2.22261e-18 │ 1.64156e-5 │

│ 144 │ -0.00628709 │ -0.00115073 │ 0.0025434 │ -0.00236983 │ 5.87108e-6 │ 0.377285 │ -0.0456993 │ 2.22261e-18 │ 1.55948e-5 │

│ 145 │ -0.00628825 │ -0.00115052 │ 0.0025434 │ -0.00237013 │ 5.57753e-6 │ 0.377303 │ -0.0457074 │ 2.22261e-18 │ 1.48151e-5 │

│ 146 │ -0.00628936 │ -0.00115032 │ 0.0025434 │ -0.00237041 │ 5.29865e-6 │ 0.377321 │ -0.045715 │ 2.24972e-18 │ 1.40743e-5 │

│ 147 │ -0.00629041 │ -0.00115013 │ 0.0025434 │ -0.00237067 │ 5.03372e-6 │ 0.377337 │ -0.0457223 │ 2.22261e-18 │ 1.33706e-5 │

│ 148 │ -0.00629141 │ -0.00114995 │ 0.0025434 │ -0.00237092 │ 4.78203e-6 │ 0.377353 │ -0.0457291 │ 2.19551e-18 │ 1.27021e-5 │

│ 149 │ -0.00629235 │ -0.00114977 │ 0.0025434 │ -0.00237116 │ 4.54293e-6 │ 0.377368 │ -0.0457357 │ 2.22261e-18 │ 1.2067e-5 │

│ 150 │ -0.00629325 │ -0.00114961 │ 0.0025434 │ -0.00237139 │ 4.31578e-6 │ 0.377383 │ -0.0457419 │ 2.19551e-18 │ 1.14636e-5 │

│ 151 │ -0.00629411 │ -0.00114945 │ 0.0025434 │ -0.00237161 │ 4.09999e-6 │ 0.377396 │ -0.0457478 │ 2.22261e-18 │ 1.08904e-5 │

│ 152 │ -0.00629492 │ -0.00114931 │ 0.0025434 │ -0.00237181 │ 3.895e-6 │ 0.377409 │ -0.0457534 │ 2.1684e-18 │ 1.03459e-5 │

│ 153 │ -0.00629569 │ -0.00114917 │ 0.0025434 │ -0.00237201 │ 3.70025e-6 │ 0.377422 │ -0.0457588 │ 2.19551e-18 │ 9.82861e-6 │

│ 154 │ -0.00629643 │ -0.00114903 │ 0.0025434 │ -0.00237219 │ 3.51523e-6 │ 0.377433 │ -0.0457638 │ 2.22261e-18 │ 9.33718e-6 │

│ 155 │ -0.00629712 │ -0.00114891 │ 0.0025434 │ -0.00237237 │ 3.33947e-6 │ 0.377445 │ -0.0457686 │ 2.22261e-18 │ 8.87032e-6 │

│ 156 │ -0.00629779 │ -0.00114879 │ 0.0025434 │ -0.00237253 │ 3.1725e-6 │ 0.377455 │ -0.0457732 │ 2.22261e-18 │ 8.42681e-6 │

│ 157 │ -0.00629842 │ -0.00114867 │ 0.0025434 │ -0.00237269 │ 3.01387e-6 │ 0.377465 │ -0.0457775 │ 2.19551e-18 │ 8.00547e-6 │

│ 158 │ -0.00629901 │ -0.00114856 │ 0.0025434 │ -0.00237284 │ 2.86318e-6 │ 0.377475 │ -0.0457817 │ 2.22261e-18 │ 7.60519e-6 │

│ 159 │ -0.00629958 │ -0.00114846 │ 0.0025434 │ -0.00237299 │ 2.72002e-6 │ 0.377484 │ -0.0457856 │ 2.24972e-18 │ 7.22493e-6 │

│ 160 │ -0.00630012 │ -0.00114836 │ 0.0025434 │ -0.00237312 │ 2.58402e-6 │ 0.377492 │ -0.0457893 │ 2.19551e-18 │ 6.86369e-6 │

│ 161 │ -0.00630063 │ -0.00114827 │ 0.0025434 │ -0.00237325 │ 2.45482e-6 │ 0.3775 │ -0.0457928 │ 2.19551e-18 │ 6.5205e-6 │

│ 162 │ -0.00630112 │ -0.00114818 │ 0.0025434 │ -0.00237337 │ 2.33208e-6 │ 0.377508 │ -0.0457962 │ 2.22261e-18 │ 6.19448e-6 │

│ 163 │ -0.00630158 │ -0.0011481 │ 0.0025434 │ -0.00237349 │ 2.21547e-6 │ 0.377516 │ -0.0457994 │ 2.22261e-18 │ 5.88475e-6 │

│ 164 │ -0.00630202 │ -0.00114802 │ 0.0025434 │ -0.0023736 │ 2.1047e-6 │ 0.377523 │ -0.0458024 │ 2.19551e-18 │ 5.59052e-6 │

│ 165 │ -0.00630244 │ -0.00114794 │ 0.0025434 │ -0.00237371 │ 1.99946e-6 │ 0.377529 │ -0.0458053 │ 2.19551e-18 │ 5.31099e-6 │

│ 166 │ -0.00630283 │ -0.00114787 │ 0.0025434 │ -0.00237381 │ 1.89949e-6 │ 0.377536 │ -0.045808 │ 2.24972e-18 │ 5.04544e-6 │

│ 167 │ -0.00630321 │ -0.0011478 │ 0.0025434 │ -0.0023739 │ 1.80452e-6 │ 0.377542 │ -0.0458106 │ 2.24972e-18 │ 4.79317e-6 │

│ 168 │ -0.00630357 │ -0.00114774 │ 0.0025434 │ -0.00237399 │ 1.71429e-6 │ 0.377547 │ -0.0458131 │ 2.19551e-18 │ 4.55351e-6 │

│ 169 │ -0.00630391 │ -0.00114767 │ 0.0025434 │ -0.00237408 │ 1.62858e-6 │ 0.377553 │ -0.0458155 │ 2.22261e-18 │ 4.32584e-6 │

│ 170 │ -0.00630423 │ -0.00114762 │ 0.0025434 │ -0.00237416 │ 1.54715e-6 │ 0.377558 │ -0.0458177 │ 2.22261e-18 │ 4.10954e-6 │

│ 171 │ -0.00630454 │ -0.00114756 │ 0.0025434 │ -0.00237424 │ 1.46979e-6 │ 0.377563 │ -0.0458198 │ 2.22261e-18 │ 3.90407e-6 │

│ 172 │ -0.00630483 │ -0.00114751 │ 0.0025434 │ -0.00237431 │ 1.3963e-6 │ 0.377567 │ -0.0458218 │ 2.19551e-18 │ 3.70886e-6 │

│ 173 │ -0.00630511 │ -0.00114746 │ 0.0025434 │ -0.00237438 │ 1.32649e-6 │ 0.377572 │ -0.0458237 │ 2.22261e-18 │ 3.52342e-6 │

│ 174 │ -0.00630537 │ -0.00114741 │ 0.0025434 │ -0.00237445 │ 1.26016e-6 │ 0.377576 │ -0.0458255 │ 2.24972e-18 │ 3.34725e-6 │

│ 175 │ -0.00630562 │ -0.00114736 │ 0.0025434 │ -0.00237451 │ 1.19715e-6 │ 0.37758 │ -0.0458273 │ 2.22261e-18 │ 3.17989e-6 │

│ 176 │ -0.00630586 │ -0.00114732 │ 0.0025434 │ -0.00237457 │ 1.1373e-6 │ 0.377584 │ -0.0458289 │ 2.24972e-18 │ 3.02089e-6 │

│ 177 │ -0.00630608 │ -0.00114728 │ 0.0025434 │ -0.00237463 │ 1.08043e-6 │ 0.377587 │ -0.0458305 │ 2.22261e-18 │ 2.86985e-6 │

│ 178 │ -0.00630629 │ -0.00114724 │ 0.0025434 │ -0.00237468 │ 1.02641e-6 │ 0.377591 │ -0.0458319 │ 2.19551e-18 │ 2.72636e-6 │

│ 179 │ -0.0063065 │ -0.0011472 │ 0.0025434 │ -0.00237473 │ 9.75089e-7 │ 0.377594 │ -0.0458333 │ 2.19551e-18 │ 2.59004e-6 │

│ 180 │ -0.00630669 │ -0.00114717 │ 0.0025434 │ -0.00237478 │ 9.26335e-7 │ 0.377597 │ -0.0458347 │ 2.22261e-18 │ 2.46054e-6 │

│ 181 │ -0.00630688 │ -0.00114713 │ 0.0025434 │ -0.00237483 │ 8.80018e-7 │ 0.3776 │ -0.045836 │ 2.22261e-18 │ 2.33751e-6 │

│ 182 │ -0.00630705 │ -0.0011471 │ 0.0025434 │ -0.00237487 │ 8.36017e-7 │ 0.377603 │ -0.0458372 │ 2.19551e-18 │ 2.22063e-6 │

│ 183 │ -0.00630722 │ -0.00114707 │ 0.0025434 │ -0.00237491 │ 7.94216e-7 │ 0.377605 │ -0.0458383 │ 2.22261e-18 │ 2.1096e-6 │

│ 184 │ -0.00630737 │ -0.00114704 │ 0.0025434 │ -0.00237495 │ 7.54505e-7 │ 0.377608 │ -0.0458394 │ 2.22261e-18 │ 2.00412e-6 │

│ 185 │ -0.00630752 │ -0.00114702 │ 0.0025434 │ -0.00237499 │ 7.1678e-7 │ 0.37761 │ -0.0458404 │ 2.22261e-18 │ 1.90392e-6 │

│ 186 │ -0.00630766 │ -0.00114699 │ 0.0025434 │ -0.00237502 │ 6.80941e-7 │ 0.377613 │ -0.0458414 │ 2.24972e-18 │ 1.80872e-6 │

│ 187 │ -0.0063078 │ -0.00114697 │ 0.0025434 │ -0.00237506 │ 6.46894e-7 │ 0.377615 │ -0.0458423 │ 2.19551e-18 │ 1.71828e-6 │

│ 188 │ -0.00630793 │ -0.00114694 │ 0.0025434 │ -0.00237509 │ 6.14549e-7 │ 0.377617 │ -0.0458432 │ 2.22261e-18 │ 1.63237e-6 │

│ 189 │ -0.00630805 │ -0.00114692 │ 0.0025434 │ -0.00237512 │ 5.83822e-7 │ 0.377619 │ -0.0458441 │ 2.22261e-18 │ 1.55075e-6 │

│ 190 │ -0.00630817 │ -0.0011469 │ 0.0025434 │ -0.00237515 │ 5.54631e-7 │ 0.377621 │ -0.0458449 │ 2.22261e-18 │ 1.47321e-6 │

│ 191 │ -0.00630828 │ -0.00114688 │ 0.0025434 │ -0.00237518 │ 5.26899e-7 │ 0.377622 │ -0.0458456 │ 2.22261e-18 │ 1.39955e-6 │

│ 192 │ -0.00630838 │ -0.00114686 │ 0.0025434 │ -0.00237521 │ 5.00554e-7 │ 0.377624 │ -0.0458463 │ 2.19551e-18 │ 1.32958e-6 │

│ 193 │ -0.00630848 │ -0.00114684 │ 0.0025434 │ -0.00237523 │ 4.75527e-7 │ 0.377626 │ -0.045847 │ 2.22261e-18 │ 1.2631e-6 │

│ 194 │ -0.00630857 │ -0.00114683 │ 0.0025434 │ -0.00237525 │ 4.5175e-7 │ 0.377627 │ -0.0458477 │ 2.19551e-18 │ 1.19994e-6 │

│ 195 │ -0.00630866 │ -0.00114681 │ 0.0025434 │ -0.00237528 │ 4.29163e-7 │ 0.377629 │ -0.0458483 │ 2.22261e-18 │ 1.13994e-6 │

│ 196 │ -0.00630875 │ -0.00114679 │ 0.0025434 │ -0.0023753 │ 4.07705e-7 │ 0.37763 │ -0.0458489 │ 2.22261e-18 │ 1.08295e-6 │

│ 197 │ -0.00630883 │ -0.00114678 │ 0.0025434 │ -0.00237532 │ 3.87319e-7 │ 0.377631 │ -0.0458494 │ 2.22261e-18 │ 1.0288e-6 │

│ 198 │ -0.00630891 │ -0.00114677 │ 0.0025434 │ -0.00237534 │ 3.67953e-7 │ 0.377632 │ -0.04585 │ 2.22261e-18 │ 9.7736e-7 │

│ 199 │ -0.00630898 │ -0.00114675 │ 0.0025434 │ -0.00237536 │ 3.49556e-7 │ 0.377634 │ -0.0458505 │ 2.22261e-18 │ 9.28492e-7 │

│ 200 │ -0.00630905 │ -0.00114674 │ 0.0025434 │ -0.00237537 │ 3.32078e-7 │ 0.377635 │ -0.0458509 │ 2.22261e-18 │ 8.82067e-7 │

└─────┴──────────────┴─────────────┴───────────┴──────────────┴─────────────┴─────────────┴──────────────┴──────────────┴─────────────┘

)

endogenous_steady_state: [0.8765480605934035, 0.15925597909882394, 0.7172920814945796, 0.33, 1.0, 0.0, 6.370239163952957, 0.045408163265306146, 1.7796581836290313]

endogenous_terminal_steady_state: Float64[]

endogenous_linear_trend: Float64[]

endogenous_quadratic_trend: Float64[]

exogenous_steady_state: [0.0]

exogenous_terminal_steady_state: Float64[]

exogenous_linear_trend: Float64[]

exogenous_quadratic_trend: Float64[]

exogenous_det_steady_state: Float64[]

exogenous_det_terminal_steady_state: Float64[]

exogenous_det_linear_trend: Float64[]

exogenous_det_quadratic_trend: Float64[]

trends:

stationary_variables: Bool[0, 1, 0, 1, 0, 1, 0, 0, 0]

estimation: Dynare.EstimationResults(Any[], Any[], Any[], Any[], Matrix{Any}(undef, 0, 0), Matrix{Any}(undef, 0, 0), 0)

filter:

forecast: AxisArrayTables.AxisArrayTable[]

initial_smoother:

linearrationalexpectations: LinearRationalExpectations.LinearRationalExpectationsResults(ComplexF64[-6.547159576546712e-14 + 0.0im, 1.0000000000000009 + 0.0im, 0.95 + 0.0im, 1.0204081632653053 + 0.0im, -3.9128173360517903e18 + 0.0im], [1.243780221740528 -0.007668729333416756 0.0744488035003834 1.3092423386742411 0.0; 21.16166434266644 -0.13891370118846832 -1.1189489888688546 22.27543615017562 0.0; 0.2684694940519445 0.007704146251565051 0.00798340303024136 0.28259946742310105 0.0; 0.2309766942652864 -0.004309102390538595 0.016318100016181728 0.24313336238451183 0.0; 0.9500000000000002 0.0 0.0 1.0 0.0; -20.18635361497786 1.143948988868793 1.1854143893389981 -21.248793278924477 0.0; 21.16166434266644 -0.1389137011884678 -0.14394898886885343 22.27543615017562 0.0; 0.06443203506344952 -0.0003972661959614108 -0.003271471851183866 0.06782319480363075 0.0; 1.279615710270776 0.007668729333418971 0.0631516912429763 1.3469639055481875 0.0], [0.9500000000000002 0.0 0.0; -20.18635361497786 1.143948988868793 1.1854143893389981; 21.16166434266644 -0.1389137011884678 -0.14394898886885343], [1.0; -21.248793278924477; 22.27543615017562;;], [1.243780221740528 -0.007668729333416756 0.0744488035003834; 21.16166434266644 -0.13891370118846832 -1.1189489888688546; 0.2684694940519445 0.007704146251565051 0.00798340303024136; 0.2309766942652864 -0.004309102390538595 0.016318100016181728; 0.06443203506344952 -0.0003972661959614108 -0.003271471851183866; 1.279615710270776 0.007668729333418971 0.0631516912429763], [1.3092423386742411; 22.27543615017562; 0.28259946742310105; 0.24313336238451183; 0.06782319480363075; 1.3469639055481875;;], [1.243780221740528 -0.007668729333416756 0.0744488035003834; 21.16166434266644 -0.13891370118846832 -1.1189489888688546; 0.2684694940519445 0.007704146251565051 0.00798340303024136; 0.2309766942652864 -0.004309102390538595 0.016318100016181728; 0.9500000000000002 0.0 0.0; -20.18635361497786 1.143948988868793 1.1854143893389981; 21.16166434266644 -0.1389137011884678 -0.14394898886885343; 0.06443203506344952 -0.0003972661959614108 -0.003271471851183866; 1.279615710270776 0.007668729333418971 0.0631516912429763], [1.3092423386742411; 22.27543615017562; 0.28259946742310105; 0.24313336238451183; 1.0; -21.248793278924477; 22.27543615017562; 0.06782319480363075; 1.3469639055481875;;], [NaN NaN NaN NaN NaN NaN NaN NaN NaN; NaN NaN NaN NaN NaN NaN NaN NaN NaN; NaN NaN NaN NaN NaN NaN NaN NaN NaN; NaN NaN NaN NaN NaN NaN NaN NaN NaN; NaN NaN NaN NaN 0.0008307692307692332 NaN NaN 5.634542337532441e-5 0.001119016167686188; NaN NaN NaN NaN NaN NaN NaN NaN NaN; NaN NaN NaN NaN NaN NaN NaN NaN NaN; NaN NaN NaN NaN 5.634542337532441e-5 NaN NaN 3.821526625877693e-6 7.589525152939298e-5; NaN NaN NaN NaN 0.001119016167686188 NaN NaN 7.589525152939298e-5 0.001507274387598151], Bool[0, 0, 0, 0, 1, 0, 0, 1, 1])

simulations: Simulation[]

smoother:

solution_derivatives: Matrix{Float64}[]

analytical_steadystate_variables: [1, 2, 3, 4, 5, 6, 7, 8, 9]

data:

datafile:

params: [0.98, 0.025, 0.33, 0.33, 1.662322802374978, 1.0, 0.95, 1.0204081632653061]

residuals: [3.8e-321, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0]

dynamic_variables: [6.9505354087861e-310, 6.95053540878454e-310, 6.950584676125e-310, 6.9505354087814e-310, 6.9505354087719e-310, 6.95053540877505e-310, 6.950584676125e-310, 6.9505772155207e-310, 6.950584676125e-310, 6.950584676125e-310, 5.0e-324, NaN, 3.560118173611523e-306, 2.9835054691953215e203]

exogenous_variables: [0.0, 0.0, 0.0]

observed_variables: String[]

Sigma_m: Matrix{Float64}(undef, 0, 0)

jacobian: Matrix{Float64}(undef, 0, 0)

qr_jacobian: Matrix{Float64}(undef, 0, 0)

model_has_trend: Bool[0]

histval: Matrix{Union{Missing, Float64}}(undef, 0, 0)

homotopy_setup: @NamedTuple{name::Symbol, type::SymbolType, index::Int64, endvalue::Float64, startvalue::Union{Missing, Float64}}[]

initval_endogenous: Matrix{Union{Missing, Float64}}(undef, 0, 0)

initval_exogenous: Matrix{Union{Missing, Float64}}(undef, 0, 0)

initval_exogenous_deterministic: Matrix{Union{Missing, Float64}}(undef, 0, 0)

endval_endogenous: Matrix{Union{Missing, Float64}}(undef, 0, 0)

endval_exogenous: Matrix{Union{Missing, Float64}}(undef, 0, 0)

endval_exogenous_deterministic: Matrix{Union{Missing, Float64}}(undef, 0, 0)

scenario: Dict{Union{Int64, Dates.UTInstant}, Dict{Union{Int64, Dates.UTInstant}, Dict{Symbol, Pair{Float64, Symbol}}}}()

shocks: Float64[]

perfect_foresight_setup: Dict{String, Any}("periods" => 0, "datafile" => "")

estimated_parameters: Dynare.EstimatedParameters(Union{Int64, Pair{Int64, Int64}}[], Union{Missing, Float64}[], Float64[], Union{Pair{String, String}, String}[], Dynare.EstimatedParameterType[], Float64[], Float64[], Float64[], Float64[], Float64[], Float64[], Distributions.Distribution[])Context(Dict{String, DynareSymbol}("c" => , "b" => , "r" => , "khi" => , "a" => , "nss" => , "bet" => , "i" => , "y" => , "del" => …), Model[], , Results(ModelResults[]), , Dict{Any, Any}(LinearRationalExpectations.LinearGsSolverWs => LinearRationalExpectations.LinearGsSolverWs(PolynomialMatrixEquations.GsSolverWs([-0.0 -65.44144306592395 63.15232318643158; 0.0 212.54490442106385 -213.12324267290856; 0.8969908102216997 104.97828081335638 -103.59687351816339], [0.34257193417969617 -0.5125980420126716 1.0590966921558524; -0.4086224242868015 -0.12043051417900291 0.0; -0.423434004723518 -0.12479583076903254 -0.0], [0.9500000000000002 0.0 0.0; -20.18635361497786 1.143948988868793 1.1854143893389981; 21.16166434266644 -0.1389137011884678 -0.14394898886885343], [0.2684694940519445 0.007704146251565051 0.00798340303024136; 0.06443203506344952 -0.0003972661959614108 -0.003271471851183866], FastLapackInterface.LUWs([2, 3, 3]), FastLapackInterface.LUWs([1, 2]), FastLapackInterface.GeneralizedSchurWs{Float64}([201.0, 1.0, 1.0, 1.0, 2.0, 1.0, 1.0, 1.0, 1.0, 1.0 … 6.95057721528433e-310, 6.9505772155207e-310, 6.9505772155207e-310, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], [-7.199102425303749e-16, 0.1734174108855597, 1.0209046767643615, 1.5992390324918113, -0.9962078827921553], [0.0, 0.0, 0.0, 0.0, 0.0], [0.010995764409183538, 0.17341741088555954, 1.0746365018572226, 1.5672542518419763, 2.5460117282075174e-19], [0.0 0.0 … 0.0 0.0; 0.0 0.0 … 0.0 0.0; … ; 0.0 0.0 … 0.0 0.0; 0.0 0.0 … 0.0 0.0], [-0.7195786905498974 -0.6943680608306576 … -0.2544558890685322 -0.07793379628649338; -0.9650203331062494 -1.3896090103083183 … -0.007458411023551919 6.427328361893521e-19; … ; -6.951031069039359e-17 -0.011093808783746191 … 0.9645130008437137 0.051339991873341664; -0.0019858721574643363 0.0026297701601203927 … -0.0721922860453784 0.9993380209428561], Base.RefValue{Int64}(3), [1, 0, 0, 1, 1], ComplexF64[-6.547159576546712e-14 + 0.0im, 1.0000000000000009 + 0.0im, 0.95 + 0.0im, 1.0204081632653053 + 0.0im, -3.9128173360517903e18 + 0.0im])), LinearRationalExpectations.Indices([1, 2, 3, 4, 5, 6, 7, 8, 9], [3, 8], [3, 8], [5, 6, 7], Int64[], [1, 2, 3, 4, 8, 9], [1, 2, 4, 9], [3, 5, 6, 7, 8], [3, 5, 6, 7, 8], [1, 2, 3, 4, 5], [1, 5], [2, 3, 4], [6, 8, 9, 10, 11], [4, 5, 7, 12], [15], 9, (D = [1, 2, 3, 4, 5], jacobian = [8, 9, 10, 13, 14]), (E = [1, 2, 3, 4, 5], jacobian = [1, 2, 3, 6, 11]), Int64[], Int64[]), [0.010995764409183538 0.5738466837386216 … 0.32790711553698915 -0.3625597880845211; 0.0 0.17341741088555954 … -2.167080632596256 1.1866161069564443; … ; 0.0 0.0 … 1.5672542518419763 0.2584165260070056; 0.0 0.0 … 0.0 2.5460117282075174e-19], [-7.199102425303749e-16 0.588407708234735 … 1.2602074879333616 -0.010534610058521599; 0.0 0.1734174108855597 … -1.834132000094353 -0.11723781341874191; … ; 0.0 0.0 … 1.5992390324918113 0.07406032654834296; -0.0 -0.0 … 0.0 -0.9962078827921553]), LinearRationalExpectations.VarianceWs => Dict{String, LinearRationalExpectations.VarianceWs}("GS" => LinearRationalExpectations.VarianceWs([8.099999999999999e-5; -0.0017211522555928825; 0.001804310328164225;;], [8.099999999999999e-5 -0.0017211522555928825 0.001804310328164225; -0.0017211522555928825 0.036572408480647745 -0.03833941717419; 0.001804310328164225 -0.03833941717419 0.04019179951012461], [6.95058467965024e-310 6.95058467978304e-310 6.95058467991585e-310; 6.95058467967237e-310 6.9505846798052e-310 6.950584679938e-310; … ; 6.95058467973878e-310 6.9505846798716e-310 6.9505846800044e-310; 6.9505846797609e-310 6.9505846798937e-310 6.9505846800265e-310], [0.0; 0.0; … ; 0.0; 0.0;;], [0.0008307692307692332 NaN NaN; NaN NaN NaN; NaN NaN NaN], [-0.016587453801836148 -0.07298143687678296 1.243780221740528; -0.003013698067143394 1.127534821498862 21.16166434266644; … ; 5.812488770370943e-18 0.0032955042866823947 0.06443203506344952; 3.258975531847689e-16 -0.0636156074909094 1.279615710270776], [4.2439915824e-314 1.485397054e-313 … 6.4e-323 0.0; 4.243991583e-314 1.485397054e-313 … 0.0 0.0; … ; 2.5e-323 1.6975966331e-313 … 0.0 0.0; 1.48539705397e-313 1.69759663317e-313 … 0.0 0.0], Bool[0, 0, 0, 0, 1, 0, 0, 1, 1], LinearRationalExpectations.NonstationaryVarianceWs[LinearRationalExpectations.NonstationaryVarianceWs([0.0008307692307692332;;], [0.9500000000000002;;], [0.06443203506344952; 1.279615710270776;;], [1.0;;], [0.06782319480363075; 1.3469639055481875;;], [5.352815220655822e-5; 0.0010630653593018786;;], [5.49367877909409e-6; 0.00010910407634940318;;], [5.634542337532441e-5; 0.001119016167686188;;], [3.821526625877693e-6 7.589525152939298e-5; 7.589525152939298e-5 0.001507274387598151], Bool[1, 0, 0], Bool[0, 0, 0, 0, 1, 1])], LinearRationalExpectations.LinearRationalExpectationsWs(LinearRationalExpectations.Indices([1, 2, 3, 4, 5, 6, 7, 8, 9], [3, 8], [3, 8], [5, 6, 7], Int64[], [1, 2, 3, 4, 8, 9], [1, 2, 4, 9], [3, 5, 6, 7, 8], [3, 5, 6, 7, 8], [1, 2, 3, 4, 5], [1, 5], [2, 3, 4], [6, 8, 9, 10, 11], [4, 5, 7, 12], [15], 9, (D = [1, 2, 3, 4, 5], jacobian = [8, 9, 10, 13, 14]), (E = [1, 2, 3, 4, 5], jacobian = [1, 2, 3, 6, 11]), Int64[], Int64[]), [-2.4748361534325016 0.40406715354187744 5.143325007715999 0.8203787662819934; 0.0 -1.3552600250241889 1.5334686017699561 0.24459373610746454; … ; -0.02093204936846925 -0.006240834563068046 0.019880737515252916 0.03444085580768032; -0.40406715354187744 0.6173942416796591 0.1918864435271711 0.33241892197900275], FastLapackInterface.QRWs{Float64}([4.0, -0.24459373610746454, -0.8203787662819934, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0 … 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 6.9504668106281e-310, 0.0], [1.0, 1.0, 1.8196954914709187, 1.4979453925872765]), FastLapackInterface.QROrmWs{Float64}([4640.0, -0.5323661645031867, -0.4981284340132076, 0.0, -2.4158403448642123e-17, 1.0489346048834656, -1.4823277672459882e-16, 0.20092595345168796, 0.5217188412131231, 0.5217188412131232 … 0.0, 0.0, 0.0, 4.61389389e-315, 5.0e-324, 0.0, 0.0, 0.0, 0.0, 0.0], [1.0, 1.0, 1.8196954914709187, 1.4979453925872765]), LinearRationalExpectations.LinearGsSolverWs(PolynomialMatrixEquations.GsSolverWs([-0.0 -65.44144306592395 63.15232318643158; 0.0 212.54490442106385 -213.12324267290856; 0.8969908102216997 104.97828081335638 -103.59687351816339], [0.34257193417969617 -0.5125980420126716 1.0590966921558524; -0.4086224242868015 -0.12043051417900291 0.0; -0.423434004723518 -0.12479583076903254 -0.0], [0.9500000000000002 0.0 0.0; -20.18635361497786 1.143948988868793 1.1854143893389981; 21.16166434266644 -0.1389137011884678 -0.14394898886885343], [0.2684694940519445 0.007704146251565051 0.00798340303024136; 0.06443203506344952 -0.0003972661959614108 -0.003271471851183866], FastLapackInterface.LUWs([2, 3, 3]), FastLapackInterface.LUWs([1, 2]), FastLapackInterface.GeneralizedSchurWs{Float64}([201.0, 1.0, 1.0, 1.0, 2.0, 1.0, 1.0, 1.0, 1.0, 1.0 … 6.95057721528433e-310, 6.9505772155207e-310, 6.9505772155207e-310, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], [-7.199102425303749e-16, 0.1734174108855597, 1.0209046767643615, 1.5992390324918113, -0.9962078827921553], [0.0, 0.0, 0.0, 0.0, 0.0], [0.010995764409183538, 0.17341741088555954, 1.0746365018572226, 1.5672542518419763, 2.5460117282075174e-19], [0.0 0.0 … 0.0 0.0; 0.0 0.0 … 0.0 0.0; … ; 0.0 0.0 … 0.0 0.0; 0.0 0.0 … 0.0 0.0], [-0.7195786905498974 -0.6943680608306576 … -0.2544558890685322 -0.07793379628649338; -0.9650203331062494 -1.3896090103083183 … -0.007458411023551919 6.427328361893521e-19; … ; -6.951031069039359e-17 -0.011093808783746191 … 0.9645130008437137 0.051339991873341664; -0.0019858721574643363 0.0026297701601203927 … -0.0721922860453784 0.9993380209428561], Base.RefValue{Int64}(3), [1, 0, 0, 1, 1], ComplexF64[-6.547159576546712e-14 + 0.0im, 1.0000000000000009 + 0.0im, 0.95 + 0.0im, 1.0204081632653053 + 0.0im, -3.9128173360517903e18 + 0.0im])), LinearRationalExpectations.Indices([1, 2, 3, 4, 5, 6, 7, 8, 9], [3, 8], [3, 8], [5, 6, 7], Int64[], [1, 2, 3, 4, 8, 9], [1, 2, 4, 9], [3, 5, 6, 7, 8], [3, 5, 6, 7, 8], [1, 2, 3, 4, 5], [1, 5], [2, 3, 4], [6, 8, 9, 10, 11], [4, 5, 7, 12], [15], 9, (D = [1, 2, 3, 4, 5], jacobian = [8, 9, 10, 13, 14]), (E = [1, 2, 3, 4, 5], jacobian = [1, 2, 3, 6, 11]), Int64[], Int64[]), [0.010995764409183538 0.5738466837386216 … 0.32790711553698915 -0.3625597880845211; 0.0 0.17341741088555954 … -2.167080632596256 1.1866161069564443; … ; 0.0 0.0 … 1.5672542518419763 0.2584165260070056; 0.0 0.0 … 0.0 2.5460117282075174e-19], [-7.199102425303749e-16 0.588407708234735 … 1.2602074879333616 -0.010534610058521599; 0.0 0.1734174108855597 … -1.834132000094353 -0.11723781341874191; … ; 0.0 0.0 … 1.5992390324918113 0.07406032654834296; -0.0 -0.0 … 0.0 -0.9962078827921553]), [0.0 0.0; -2.220446049250313e-16 6.022743068156977e-17; 4.040535664875208e-16 -2.020267832437604e-16; 2.220446049250313e-16 -1.6635863447664288e-16], [1.243780221740528 -0.007668729333416756 0.0744488035003834; 21.16166434266644 -0.13891370118846832 -1.1189489888688546; 0.2309766942652864 -0.004309102390538595 0.016318100016181728; 1.279615710270776 0.007668729333418971 0.0631516912429763], [0.2684694940519445 0.007704146251565051 0.00798340303024136; 0.06443203506344952 -0.0003972661959614108 -0.003271471851183866], [0.2684694940519445 0.007704146251565051 0.00798340303024136; 0.9500000000000002 0.0 0.0; … ; 21.16166434266644 -0.1389137011884678 -0.14394898886885343; 0.06443203506344952 -0.0003972661959614108 -0.003271471851183866], [0.0 0.0 0.0; -5.573162681573067e-17 -1.7345904329928195e-18 -1.9697039159511234e-18; 9.545905978307053e-17 3.1931461813478926e-18 3.886647401643489e-18; 4.889337737148042e-17 1.7767527725972935e-18 2.3169091616989637e-18], [0.0 0.0 0.0; -5.573162681573067e-17 -1.7345904329928195e-18 -1.9697039159511234e-18; … ; -0.0009242070652749744 3.771741148298436e-5 0.00012087045464238305; -0.27487093024529097 -0.0066477922120638695 -0.005309984147997485], [0.0 0.0; -2.220446049250313e-16 6.022743068156977e-17; … ; 0.0034210451942872436 -0.02859840350998617; -0.8913519296904336 -0.5520565759571017], [-2.4748361534325016 0.40406715354187744 … 0.02093204936846925 0.8203787662819934; 0.0 -1.3552600250241889 … 0.006240834563068047 0.24459373610746454; … ; 0.0 2.0170452922901044e-18 … 0.9977991772308227 0.0; 0.0 -9.155402834673784e-17 … -0.021242071813838203 5.551115123125783e-17], [-2.4748361534325016 0.40406715354187744 5.143325007715999 0.8203787662819934; -0.0 -1.3552600250241889 1.5334686017699564 0.24459373610746454; -0.0 -2.8604253219368703e-17 3.2404792656062478 -0.5733269507737448; -0.0 -3.219063261578994e-17 1.5233340608396258e-17 0.9687356665298881], [0.4040671535418776 0.3541842797866297 … 0.0 0.02093204936846925; -0.617394241679659 0.10559909620303977 … 0.7378657833445297 0.006240834563068047; 1.6845542179826096 -0.13074048554685985 … -0.3491748961607823 -0.03617688842362249; -1.750483525680795 -0.40398139286109425 … -0.39295417764506896 -0.040712719031542596], [-2.4748361534325016 0.40406715354187744 … 0.02093204936846925 0.8203787662819934; -0.0 -1.3552600250241889 … 0.006240834563068047 0.24459373610746454; … ; -0.0 -1.4883087046370338e-18 … 0.9990792072471805 0.03011405247624054; -0.0 6.755458484441298e-17 … -0.05175982200993 1.2185731264680362], FastLapackInterface.LUWs([1, 2, 3, 4]), FastLapackInterface.LUWs([1, 2, 7, 7, 6, 7, 7, 8, 9])), LinearRationalExpectations.LyapdWs([1.000000000000002 -1.324328090527466 -22.59013948909541; 0.0 -6.23945339839338e-14 -18.573920100071014; 0.0 0.0 0.9500000000000002], [-1.0000000000000624 8.263083405029412e-14 -21.460632514640643; 0.0 -1.0 -17.645224095067466; -0.0 -0.0 -0.0974999999999997], [5.0e-324 5.0e-324 … 5.0e-324 5.0e-324; 6.9504670927767e-310 6.95046709278146e-310 … 6.9504670927957e-310 6.95046709280043e-310; … ; 5.0e-324 5.0e-324 … 5.0e-324 5.0e-324; 6.9504670927799e-310 6.9504670927846e-310 … 6.95046709279885e-310 6.9504670928036e-310], [5.0e-324 1.5e-323 … 2.0e-323 2.5e-323; 6.9504670927767e-310 6.95046709278146e-310 … 6.9504670927957e-310 6.95046709280043e-310; … ; 1.5e-323 1.5e-323 … 2.0e-323 2.5e-323; 6.9504670927799e-310 6.9504670927846e-310 … 6.95046709279885e-310 6.9504670928036e-310], [0.14472693453521557 -0.26601449131556487 -0.0019261066301229088; -0.2660144913155648 0.3175706358529605 -0.0015836710822166105; -0.0019261066301229088 -0.0015836710822166105 8.099999999999999e-5], [0.013605839014500735 -0.016242780330425585 0.0008307692307692332; 0.032067494332382124 -0.3023570634778873 0.01546465198280445; 0.2640745830198328 -0.2831872605025486 0.01448417437073004], [6.9504663504435e-310, 6.95046635044427e-310, 6.95057721507247e-310, 6.9505772150361e-310, 6.9505772150361e-310, 6.95057721507563e-310], Bool[0, 1, 1], Bool[1, 0, 0], FastLapackInterface.SchurWs{Float64}([102.0, 1.0, 1.0, 3.0, 0.0, 6.9505846763965e-310, 32.0, 6.9504678112952e-310, 6.9504678112952e-310, 6.9504678112952e-310 … 6.95057709456867e-310, 6.95058467763603e-310, 6.95057565532857e-310, 6.95058467765817e-310, 6.9505846776803e-310, 6.95058467770243e-310, 6.950584676125e-310, 6.9505846777467e-310, 6.9505846772819e-310, 6.9505846765072e-310], [1.000000000000002, -6.23945339839338e-14, 0.9500000000000002], [0.0, 0.0, 0.0], [0.0 0.0 1.0; 0.992707508955261 -0.12054792268571038 0.0; -0.12054792268571038 -0.992707508955261 0.0], Base.RefValue{Int64}(1), [0, 1, 0], ComplexF64[2.1219957915e-314 + 2.1219957915e-314im, 4.2439915824e-314 + 4.243991583e-314im, 6.3659873744e-314 + 1.0609978957e-313im]), FastLapackInterface.LUWs([1, 2]), FastLapackInterface.LUWs([0, 0, 0, 0, 0, 0])))), LinearRationalExpectations.LinearRationalExpectationsWs => Dict{String, LinearRationalExpectations.LinearRationalExpectationsWs}("GS" => LinearRationalExpectations.LinearRationalExpectationsWs(LinearRationalExpectations.Indices([1, 2, 3, 4, 5, 6, 7, 8, 9], [3, 8], [3, 8], [5, 6, 7], Int64[], [1, 2, 3, 4, 8, 9], [1, 2, 4, 9], [3, 5, 6, 7, 8], [3, 5, 6, 7, 8], [1, 2, 3, 4, 5], [1, 5], [2, 3, 4], [6, 8, 9, 10, 11], [4, 5, 7, 12], [15], 9, (D = [1, 2, 3, 4, 5], jacobian = [8, 9, 10, 13, 14]), (E = [1, 2, 3, 4, 5], jacobian = [1, 2, 3, 6, 11]), Int64[], Int64[]), [-2.4748361534325016 0.40406715354187744 5.143325007715999 0.8203787662819934; 0.0 -1.3552600250241889 1.5334686017699561 0.24459373610746454; … ; -0.02093204936846925 -0.006240834563068046 0.019880737515252916 0.03444085580768032; -0.40406715354187744 0.6173942416796591 0.1918864435271711 0.33241892197900275], FastLapackInterface.QRWs{Float64}([4.0, -0.24459373610746454, -0.8203787662819934, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0 … 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 6.9504668106281e-310, 0.0], [1.0, 1.0, 1.8196954914709187, 1.4979453925872765]), FastLapackInterface.QROrmWs{Float64}([4640.0, -0.5323661645031867, -0.4981284340132076, 0.0, -2.4158403448642123e-17, 1.0489346048834656, -1.4823277672459882e-16, 0.20092595345168796, 0.5217188412131231, 0.5217188412131232 … 0.0, 0.0, 0.0, 4.61389389e-315, 5.0e-324, 0.0, 0.0, 0.0, 0.0, 0.0], [1.0, 1.0, 1.8196954914709187, 1.4979453925872765]), LinearRationalExpectations.LinearGsSolverWs(PolynomialMatrixEquations.GsSolverWs([-0.0 -65.44144306592395 63.15232318643158; 0.0 212.54490442106385 -213.12324267290856; 0.8969908102216997 104.97828081335638 -103.59687351816339], [0.34257193417969617 -0.5125980420126716 1.0590966921558524; -0.4086224242868015 -0.12043051417900291 0.0; -0.423434004723518 -0.12479583076903254 -0.0], [0.9500000000000002 0.0 0.0; -20.18635361497786 1.143948988868793 1.1854143893389981; 21.16166434266644 -0.1389137011884678 -0.14394898886885343], [0.2684694940519445 0.007704146251565051 0.00798340303024136; 0.06443203506344952 -0.0003972661959614108 -0.003271471851183866], FastLapackInterface.LUWs([2, 3, 3]), FastLapackInterface.LUWs([1, 2]), FastLapackInterface.GeneralizedSchurWs{Float64}([201.0, 1.0, 1.0, 1.0, 2.0, 1.0, 1.0, 1.0, 1.0, 1.0 … 6.95057721528433e-310, 6.9505772155207e-310, 6.9505772155207e-310, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], [-7.199102425303749e-16, 0.1734174108855597, 1.0209046767643615, 1.5992390324918113, -0.9962078827921553], [0.0, 0.0, 0.0, 0.0, 0.0], [0.010995764409183538, 0.17341741088555954, 1.0746365018572226, 1.5672542518419763, 2.5460117282075174e-19], [0.0 0.0 … 0.0 0.0; 0.0 0.0 … 0.0 0.0; … ; 0.0 0.0 … 0.0 0.0; 0.0 0.0 … 0.0 0.0], [-0.7195786905498974 -0.6943680608306576 … -0.2544558890685322 -0.07793379628649338; -0.9650203331062494 -1.3896090103083183 … -0.007458411023551919 6.427328361893521e-19; … ; -6.951031069039359e-17 -0.011093808783746191 … 0.9645130008437137 0.051339991873341664; -0.0019858721574643363 0.0026297701601203927 … -0.0721922860453784 0.9993380209428561], Base.RefValue{Int64}(3), [1, 0, 0, 1, 1], ComplexF64[-6.547159576546712e-14 + 0.0im, 1.0000000000000009 + 0.0im, 0.95 + 0.0im, 1.0204081632653053 + 0.0im, -3.9128173360517903e18 + 0.0im])), LinearRationalExpectations.Indices([1, 2, 3, 4, 5, 6, 7, 8, 9], [3, 8], [3, 8], [5, 6, 7], Int64[], [1, 2, 3, 4, 8, 9], [1, 2, 4, 9], [3, 5, 6, 7, 8], [3, 5, 6, 7, 8], [1, 2, 3, 4, 5], [1, 5], [2, 3, 4], [6, 8, 9, 10, 11], [4, 5, 7, 12], [15], 9, (D = [1, 2, 3, 4, 5], jacobian = [8, 9, 10, 13, 14]), (E = [1, 2, 3, 4, 5], jacobian = [1, 2, 3, 6, 11]), Int64[], Int64[]), [0.010995764409183538 0.5738466837386216 … 0.32790711553698915 -0.3625597880845211; 0.0 0.17341741088555954 … -2.167080632596256 1.1866161069564443; … ; 0.0 0.0 … 1.5672542518419763 0.2584165260070056; 0.0 0.0 … 0.0 2.5460117282075174e-19], [-7.199102425303749e-16 0.588407708234735 … 1.2602074879333616 -0.010534610058521599; 0.0 0.1734174108855597 … -1.834132000094353 -0.11723781341874191; … ; 0.0 0.0 … 1.5992390324918113 0.07406032654834296; -0.0 -0.0 … 0.0 -0.9962078827921553]), [0.0 0.0; -2.220446049250313e-16 6.022743068156977e-17; 4.040535664875208e-16 -2.020267832437604e-16; 2.220446049250313e-16 -1.6635863447664288e-16], [1.243780221740528 -0.007668729333416756 0.0744488035003834; 21.16166434266644 -0.13891370118846832 -1.1189489888688546; 0.2309766942652864 -0.004309102390538595 0.016318100016181728; 1.279615710270776 0.007668729333418971 0.0631516912429763], [0.2684694940519445 0.007704146251565051 0.00798340303024136; 0.06443203506344952 -0.0003972661959614108 -0.003271471851183866], [0.2684694940519445 0.007704146251565051 0.00798340303024136; 0.9500000000000002 0.0 0.0; … ; 21.16166434266644 -0.1389137011884678 -0.14394898886885343; 0.06443203506344952 -0.0003972661959614108 -0.003271471851183866], [0.0 0.0 0.0; -5.573162681573067e-17 -1.7345904329928195e-18 -1.9697039159511234e-18; 9.545905978307053e-17 3.1931461813478926e-18 3.886647401643489e-18; 4.889337737148042e-17 1.7767527725972935e-18 2.3169091616989637e-18], [0.0 0.0 0.0; -5.573162681573067e-17 -1.7345904329928195e-18 -1.9697039159511234e-18; … ; -0.0009242070652749744 3.771741148298436e-5 0.00012087045464238305; -0.27487093024529097 -0.0066477922120638695 -0.005309984147997485], [0.0 0.0; -2.220446049250313e-16 6.022743068156977e-17; … ; 0.0034210451942872436 -0.02859840350998617; -0.8913519296904336 -0.5520565759571017], [-2.4748361534325016 0.40406715354187744 … 0.02093204936846925 0.8203787662819934; 0.0 -1.3552600250241889 … 0.006240834563068047 0.24459373610746454; … ; 0.0 2.0170452922901044e-18 … 0.9977991772308227 0.0; 0.0 -9.155402834673784e-17 … -0.021242071813838203 5.551115123125783e-17], [-2.4748361534325016 0.40406715354187744 5.143325007715999 0.8203787662819934; -0.0 -1.3552600250241889 1.5334686017699564 0.24459373610746454; -0.0 -2.8604253219368703e-17 3.2404792656062478 -0.5733269507737448; -0.0 -3.219063261578994e-17 1.5233340608396258e-17 0.9687356665298881], [0.4040671535418776 0.3541842797866297 … 0.0 0.02093204936846925; -0.617394241679659 0.10559909620303977 … 0.7378657833445297 0.006240834563068047; 1.6845542179826096 -0.13074048554685985 … -0.3491748961607823 -0.03617688842362249; -1.750483525680795 -0.40398139286109425 … -0.39295417764506896 -0.040712719031542596], [-2.4748361534325016 0.40406715354187744 … 0.02093204936846925 0.8203787662819934; -0.0 -1.3552600250241889 … 0.006240834563068047 0.24459373610746454; … ; -0.0 -1.4883087046370338e-18 … 0.9990792072471805 0.03011405247624054; -0.0 6.755458484441298e-17 … -0.05175982200993 1.2185731264680362], FastLapackInterface.LUWs([1, 2, 3, 4]), FastLapackInterface.LUWs([1, 2, 7, 7, 6, 7, 7, 8, 9]))), LinearRationalExpectations.LyapdWs => LinearRationalExpectations.LyapdWs([1.000000000000002 -1.324328090527466 -22.59013948909541; 0.0 -6.23945339839338e-14 -18.573920100071014; 0.0 0.0 0.9500000000000002], [-1.0000000000000624 8.263083405029412e-14 -21.460632514640643; 0.0 -1.0 -17.645224095067466; -0.0 -0.0 -0.0974999999999997], [5.0e-324 5.0e-324 … 5.0e-324 5.0e-324; 6.9504670927767e-310 6.95046709278146e-310 … 6.9504670927957e-310 6.95046709280043e-310; … ; 5.0e-324 5.0e-324 … 5.0e-324 5.0e-324; 6.9504670927799e-310 6.9504670927846e-310 … 6.95046709279885e-310 6.9504670928036e-310], [5.0e-324 1.5e-323 … 2.0e-323 2.5e-323; 6.9504670927767e-310 6.95046709278146e-310 … 6.9504670927957e-310 6.95046709280043e-310; … ; 1.5e-323 1.5e-323 … 2.0e-323 2.5e-323; 6.9504670927799e-310 6.9504670927846e-310 … 6.95046709279885e-310 6.9504670928036e-310], [0.14472693453521557 -0.26601449131556487 -0.0019261066301229088; -0.2660144913155648 0.3175706358529605 -0.0015836710822166105; -0.0019261066301229088 -0.0015836710822166105 8.099999999999999e-5], [0.013605839014500735 -0.016242780330425585 0.0008307692307692332; 0.032067494332382124 -0.3023570634778873 0.01546465198280445; 0.2640745830198328 -0.2831872605025486 0.01448417437073004], [6.9504663504435e-310, 6.95046635044427e-310, 6.95057721507247e-310, 6.9505772150361e-310, 6.9505772150361e-310, 6.95057721507563e-310], Bool[0, 1, 1], Bool[1, 0, 0], FastLapackInterface.SchurWs{Float64}([102.0, 1.0, 1.0, 3.0, 0.0, 6.9505846763965e-310, 32.0, 6.9504678112952e-310, 6.9504678112952e-310, 6.9504678112952e-310 … 6.95057709456867e-310, 6.95058467763603e-310, 6.95057565532857e-310, 6.95058467765817e-310, 6.9505846776803e-310, 6.95058467770243e-310, 6.950584676125e-310, 6.9505846777467e-310, 6.9505846772819e-310, 6.9505846765072e-310], [1.000000000000002, -6.23945339839338e-14, 0.9500000000000002], [0.0, 0.0, 0.0], [0.0 0.0 1.0; 0.992707508955261 -0.12054792268571038 0.0; -0.12054792268571038 -0.992707508955261 0.0], Base.RefValue{Int64}(1), [0, 1, 0], ComplexF64[2.1219957915e-314 + 2.1219957915e-314im, 4.2439915824e-314 + 4.243991583e-314im, 6.3659873744e-314 + 1.0609978957e-313im]), FastLapackInterface.LUWs([1, 2]), FastLapackInterface.LUWs([0, 0, 0, 0, 0, 0]))))Print theoretical moments. Comment.

In the output from the above question we have:

THEORETICAL MOMENTS

──────────┬─────────────────────────────

VARIABLE │ MEAN STD. DEV. VARIANCE

────────────────────────────────────────

y │ NaN NaN NaN

k │ NaN NaN NaN

i │ NaN NaN NaN

c │ NaN NaN NaN

n │ NaN NaN NaN

a │ 1.0 0.0288 0.0008

b │ NaN NaN NaN

r │ 0.0454 0.002 0.0

w │ 1.7797 0.0388 0.0015

──────────┴─────────────────────────────We can see that Dynare cannot compute the moments (mean and standard deviation) for all variables. This is a property associated to the existence of a unit root: the ergodic distribution of this variables is undefined.

We say the model is non-stationary.

Simulate the model over 100 periods. Comment.

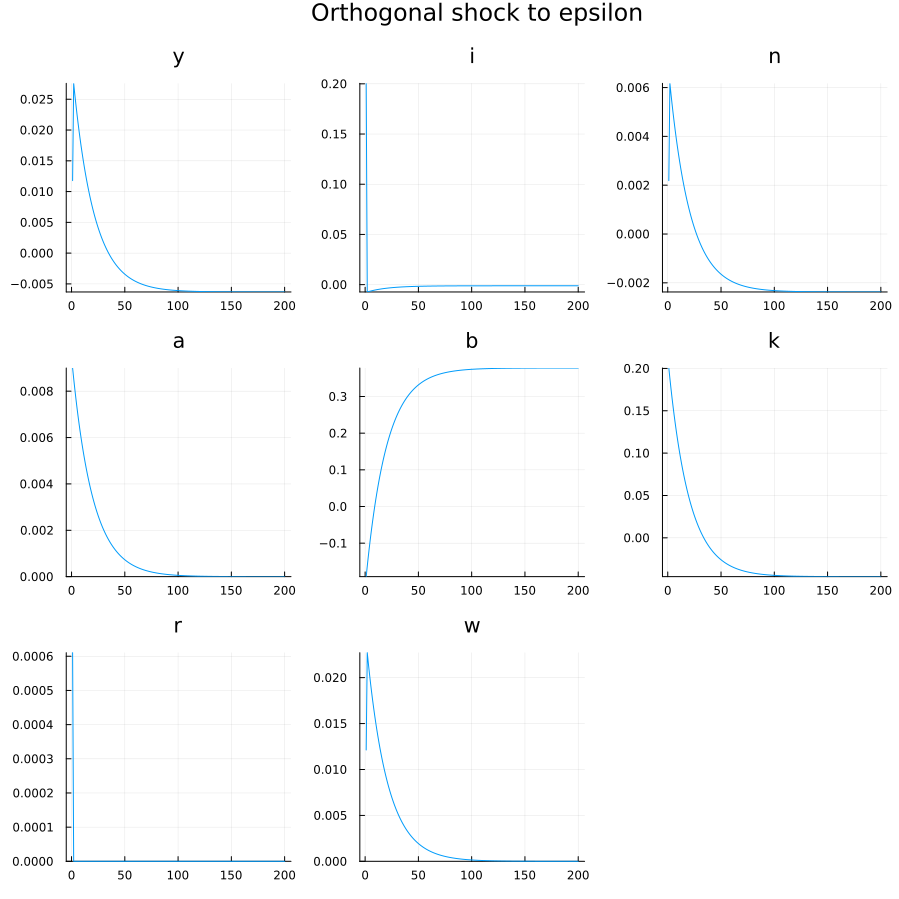

The simulation horizon is specified in the stoch_simul(irf=200, order=1) as the argument to the irf keyword. The result is stored in the rbc_open/graphs subfolder.

Note that dynare-matlab allows you to select which variables to plot by adding a list of variables after the command (as in stoch_simul(irf=200, order=1) y c i b). This functionality has not been ported yet to Dynare Julia which prints by default the 8 first variables. You can instead

- reorder the variables in the declaration statement to list first the ones we want to print

- make a custom plot with Plots.jl (we do in the last question)

Even with a unit root, the model can be solved and simulated.

Since the opening up of the economy, in response to the productivity shock capital flows in to finance a jump in investment.

The irfs show a persistent effect of the shock on the debt position, as well as most other variables.

When the savings of all households increase, there is no stabilizing force to bring them back to their original level.

Households and as a result the whole country behaves like a ricardian agent: they increase their consumption permanently by consuming the interests on their assets.

Since their consumption increase their consumption leisure tradeoff is also modified, which is why the labour supply is also permanently changed.

Since the return on capital must be kept equal to world interest rate (by the arbitrage condition), it returns to the steady-state after one period.

Assume the foreign interest rate depends on the amount of foreign assets

\[r^{\star}_t=\frac{1}{\beta} + exp(-\kappa b^{\star}_t) - 1\]

with \(\kappa=0.001\). How do you interpret the equation for \(r^{\star}_t\). How should you modify the model equations?

With this specification, when the representative housheold holds more assets, their return decrease. This could be a proxy for the fact that international markets have limited depth.

Conversely, when the domestic household become more indebted, international lenders require a higher interest rate. In that case, it could mean that international investors don’t have infinitely deep pockets or interpreted as a higher risk premium.

The precise specification is also chosen so that it collapses to the \(r^{\star}=\frac{1}{\beta}\) when \(b^{\star}_t=0\). This allows us to keep essentially the same steady-state as before for all other variables.

To update the modfile, we need to declare \(r^{\star}\) as a variable not a parameter and move its steady-state value \(r^{\star} = \frac{1}{β}\) to the block steady_state_model;. Finally the above equation endogenizing the interest rate must augment the model; block.

Note that the Euler equation is unchanged by the addition of the endogenous interest rate. This is because the households (and as a result the representative household) does not internalize the effect of its borrowing/saving on the interest rate when it chooses its optimal decisions.

Update the modfile and comment on the generated moments. Do they depend on the choice of \(\kappa\)?

using Dynare

#run modified modfile rbc_open_stationary

# save result for future comparison

context_stationary = @dynare "rbc_open_stationary.mod";Dynare version: 0.9.18

2025-04-16T13:56:28.671: Starting @dynare rbc_open_stationary.mod

["rbc_open_stationary.mod", "language=julia", "json=compute"]

Dynare preprocessor version: 6.4.0+0

2025-04-16T13:56:28.677: End of preprocessing

2025-04-16T13:56:28.680: Start parse_statements!Starting preprocessing of the model file ...

Found 10 equation(s).

Evaluating expressions...

Computing static model derivatives (order 1).

Normalizing the static model...

Finding the optimal block decomposition of the static model...

2 block(s) found:

1 recursive block(s) and 1 simultaneous block(s).

the largest simultaneous block has 9 equation(s)

and 7 feedback variable(s).

Computing dynamic model derivatives (order 1).

Normalizing the dynamic model...

Finding the optimal block decomposition of the dynamic model...

2 block(s) found:

1 recursive block(s) and 1 simultaneous block(s).

the largest simultaneous block has 9 equation(s)

and 8 feedback variable(s).

JSON written after Computing step.

Preprocessing completed.

Coefficients of approximate solution function (reduced form)

───────────┬──────────────────────────────────────────────────────────────────────────────────────

│ k_t i_t y_t a_t n_t c_t b_t r_t w_t rst_t

──────────────────────────────────────────────────────────────────────────────────────────────────

ϕ(k) │ -0.0636 -1.0386 0.0575 0.0 0.0068 0.0251 1.071 -0.0042 0.0801 -0.0011

ϕ(a) │ 13.9608 13.9608 1.1113 0.95 0.1565 0.4015 -13.251 0.0576 1.4121 0.0133

ϕ(b) │ -0.0614 -0.0614 -0.0241 0.0 -0.0135 0.0242 1.0336 -0.0012 0.0241 -0.001

epsilon_t │ 14.6956 14.6956 1.1698 1.0 0.1648 0.4227 -13.9484 0.0606 1.4864 0.0139

───────────┴──────────────────────────────────────────────────────────────────────────────────────

Note: ϕ(x) = x_{t-1} - steady_state(x)

THEORETICAL MOMENTS

──────────┬─────────────────────────────

VARIABLE │ MEAN STD. DEV. VARIANCE

────────────────────────────────────────

k │ 6.3702 0.3979 0.1583

i │ 0.1593 0.1329 0.0177

y │ 0.8765 0.057 0.0033

a │ 1.0 0.0288 0.0008

n │ 0.33 0.0109 0.0001

c │ 0.7173 0.0272 0.0007

b │ 0.0 0.6257 0.3914

r │ 0.0454 0.0008 0.0

w │ 1.7797 0.076 0.0058

rst │ 1.0204 0.0006 0.0

──────────┴─────────────────────────────

VARIANCE DECOMPOSITION (in percent)

──────────┬─────────

VARIABLE │ epsilon

────────────────────

k │ 1.0

i │ 1.0

y │ 1.0

a │ 1.0

n │ 1.0

c │ 1.0

b │ 1.0

r │ 1.0

w │ 1.0

rst │ 1.0

──────────┴─────────

CORRELATION MATRIX

─────┬────────────────────────────────────────────────────────────────────────────────────────

│ k i y a n c b r w rst

──────────────────────────────────────────────────────────────────────────────────────────────

k │ 1.0 0.2409 0.967 0.9957 0.6693 0.791 0.0014 0.2193 0.9564 -0.0014

i │ 0.2409 1.0 0.0938 0.2199 0.0783 0.0593 -0.2142 0.6598 0.0824 0.2142

y │ 0.967 0.0938 1.0 0.9467 0.8147 0.6588 -0.1721 0.2799 0.8943 0.1721

a │ 0.9957 0.2199 0.9467 1.0 0.6012 0.8444 0.0944 0.1376 0.978 -0.0944

n │ 0.6693 0.0783 0.8147 0.6012 1.0 0.1005 -0.7 0.646 0.4693 0.7

c │ 0.791 0.0593 0.6588 0.8444 0.1005 1.0 0.613 -0.358 0.9258 -0.613

b │ 0.0014 -0.2142 -0.1721 0.0944 -0.7 0.613 1.0 -0.8682 0.278 -1.0

r │ 0.2193 0.6598 0.2799 0.1376 0.646 -0.358 -0.8682 1.0 -0.0722 0.8682

w │ 0.9564 0.0824 0.8943 0.978 0.4693 0.9258 0.278 -0.0722 1.0 -0.278

rst │ -0.0014 0.2142 0.1721 -0.0944 0.7 -0.613 -1.0 0.8682 -0.278 1.0

─────┴────────────────────────────────────────────────────────────────────────────────────────

AUTOCORRELATION COEFFICIENTS

─────┬─────────────────────────────────────────────

│ 1 2 3 4 5

───────────────────────────────────────────────────

k │ 0.9431 0.8893 0.8384 0.7902 0.7446

i │ -0.0214 -0.0203 -0.0193 -0.0183 -0.0174

y │ 0.9648 0.8966 0.8323 0.7719 0.715

a │ 0.95 0.9025 0.8574 0.8145 0.7738

n │ 0.9596 0.8873 0.8193 0.7554 0.6955

c │ 0.9901 0.9795 0.9682 0.9564 0.944

b │ 0.9769 0.9542 0.9318 0.9097 0.8881

r │ 0.6545 0.6272 0.601 0.5761 0.5522

w │ 0.9797 0.9431 0.9079 0.8741 0.8416

rst │ 0.9769 0.9542 0.9318 0.9097 0.8881

─────┴─────────────────────────────────────────────

2025-04-16T13:56:28.952: End parse_statements!

2025-04-16T13:56:28.952: End parserWith the addition of a small friction we obtain the well defined following moments:

THEORETICAL MOMENTS

──────────┬─────────────────────────────

VARIABLE │ MEAN STD. DEV. VARIANCE

────────────────────────────────────────

k │ 6.3702 0.3979 0.1583

i │ 0.1593 0.1329 0.0177

y │ 0.8765 0.057 0.0033

a │ 1.0 0.0288 0.0008

n │ 0.33 0.0109 0.0001

c │ 0.7173 0.0272 0.0007

b │ 0.0 0.6257 0.3914

r │ 0.0454 0.0008 0.0

w │ 1.7797 0.076 0.0058

rst │ 1.0204 0.0006 0.0

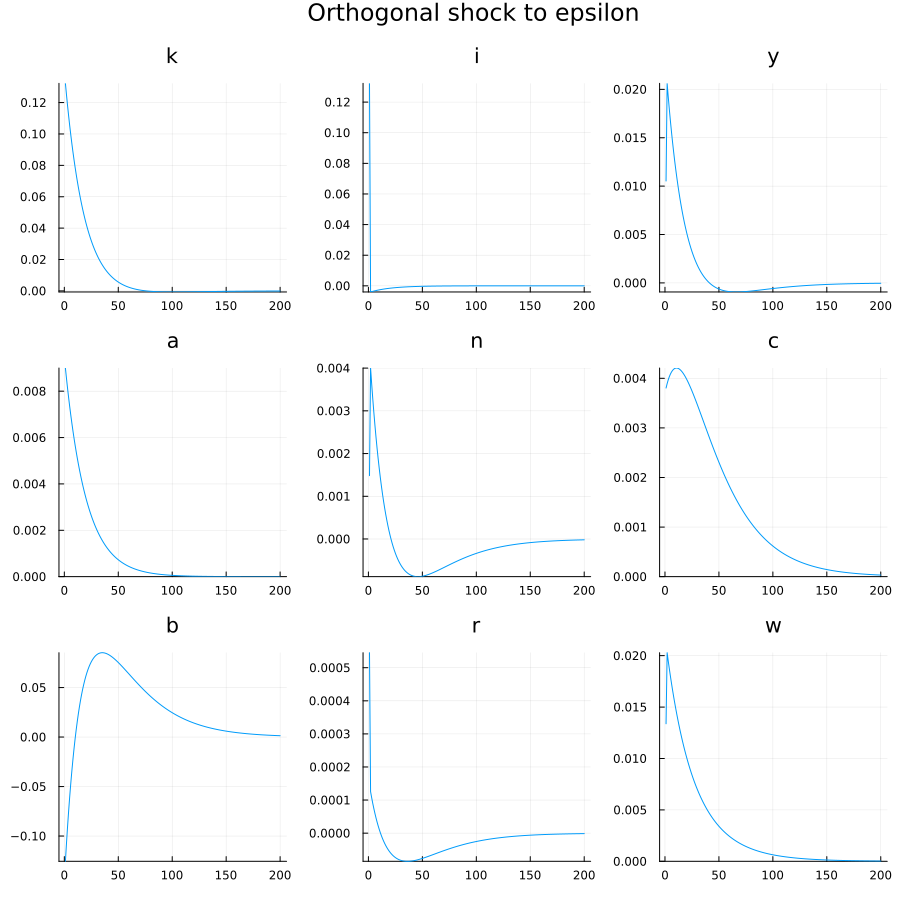

──────────┴─────────────────────────────We obtain the following irf:

As before there is a jump in investment, financed by external borrowing (\(b\) becomes negative). Since effect is slowed down by an increase in the interest rate.

If we set \(\kappa=0.005\) instead we obtain the following theoretical moments:

THEORETICAL MOMENTS

──────────┬────────────────────────────────────────────────────────

VARIABLE │ STD. DEV. (kappa=0.001) STD. DEV. (kappa=0.005)

───────────────────────────────────────────────────────────────────

k │ 0.3979 0.4371

i │ 0.1329 0.1551

y │ 0.057 0.063

a │ 0.0288 0.0288

n │ 0.0109 0.0137

c │ 0.0272 0.0272

b │ 0.6257 0.9907

r │ 0.0008 0.0007

w │ 0.076 0.0758

rst │ 0.0006 0.0005

──────────┴──────────────────────────────────────────────────────── We observe rather high increase in the volatility of debt, but milder changes for capital, investment, output, labour, wages… In particular the RBC moments (std dev of investment / consumption over std dev of production) move very little.

Another interesting exercise consists in comparing the impulse response functions obtained with \(\kappa=0.000\), \(\kappa=0.001\) and \(\kappa=0.005\) (see code below).

In the short run, the dynamic responses are very similar for all variables, except consumption which does not jump anymore to its long run trend as long as there is a small friction on the interest rate. Overall the addition of the friction slows down the adjustment of production variables to the productivty shock.

In the long run, the friction implies a return to the initial steady-state counteracting the short term effect of the exogenous shock.

context_stationary_high_kappa = @dynare "rbc_open_stationary_kappa05.mod";Dynare version: 0.9.18

2025-04-16T13:56:32.457: Starting @dynare rbc_open_stationary_kappa05.mod

["rbc_open_stationary_kappa05.mod", "language=julia", "json=compute"]

Dynare preprocessor version: 6.4.0+0Starting preprocessing of the model file ...

Found 10 equation(s).

Evaluating expressions...

Computing static model derivatives (order 1).

Normalizing the static model...2025-04-16T13:56:32.463: End of preprocessing

2025-04-16T13:56:32.466: Start parse_statements!

Coefficients of approximate solution function (reduced form)

───────────┬────────────────────────────────────────────────────────────────────────────────────

│ k_t i_t y_t a_t n_t c_t b_t r_t w_t rst_t

────────────────────────────────────────────────────────────────────────────────────────────────

ϕ(k) │ 0.3486 -0.6264 0.0394 0.0 -0.0034 0.0432 0.6226 -0.0051 0.0982 -0.0031

ϕ(a) │ 7.2694 7.2694 1.1293 0.95 0.1667 0.3834 -6.5236 0.0585 1.3941 0.0326

ϕ(b) │ 0.3364 0.3364 -0.0415 0.0 -0.0233 0.0417 0.6008 -0.0022 0.0415 -0.003

epsilon_t │ 7.652 7.652 1.1888 1.0 0.1754 0.4036 -6.8669 0.0616 1.4674 0.0343

───────────┴────────────────────────────────────────────────────────────────────────────────────

Note: ϕ(x) = x_{t-1} - steady_state(x)

THEORETICAL MOMENTS

──────────┬─────────────────────────────

VARIABLE │ MEAN STD. DEV. VARIANCE

────────────────────────────────────────

k │ 6.3702 0.3369 0.1135

i │ 0.1593 0.069 0.0048

y │ 0.8765 0.0474 0.0022

a │ 1.0 0.0288 0.0008

n │ 0.33 0.0065 0.0

c │ 0.7173 0.0273 0.0007

b │ 0.0 0.1875 0.0351

r │ 0.0454 0.0011 0.0

w │ 1.7797 0.0743 0.0055

rst │ 1.0204 0.0009 0.0

──────────┴─────────────────────────────

VARIANCE DECOMPOSITION (in percent)

──────────┬─────────

VARIABLE │ epsilon

────────────────────

k │ 1.0

i │ 1.0

y │ 1.0

a │ 1.0

n │ 1.0

c │ 1.0

b │ 1.0

r │ 1.0

w │ 1.0

rst │ 1.0

──────────┴─────────

CORRELATION MATRIX

─────┬──────────────────────────────────────────────────────────────────────────────────────────

│ k i y a n c b r w rst

────────────────────────────────────────────────────────────────────────────────────────────────

k │ 1.0 0.223 0.9303 0.9508 0.4379 0.9839 0.208 -0.0631 0.9981 -0.208

i │ 0.223 1.0 0.2601 0.3426 0.2921 0.1441 -0.3659 0.5445 0.1991 0.3659