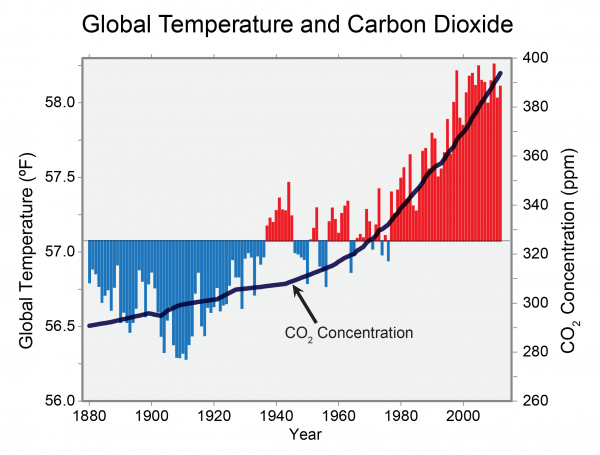

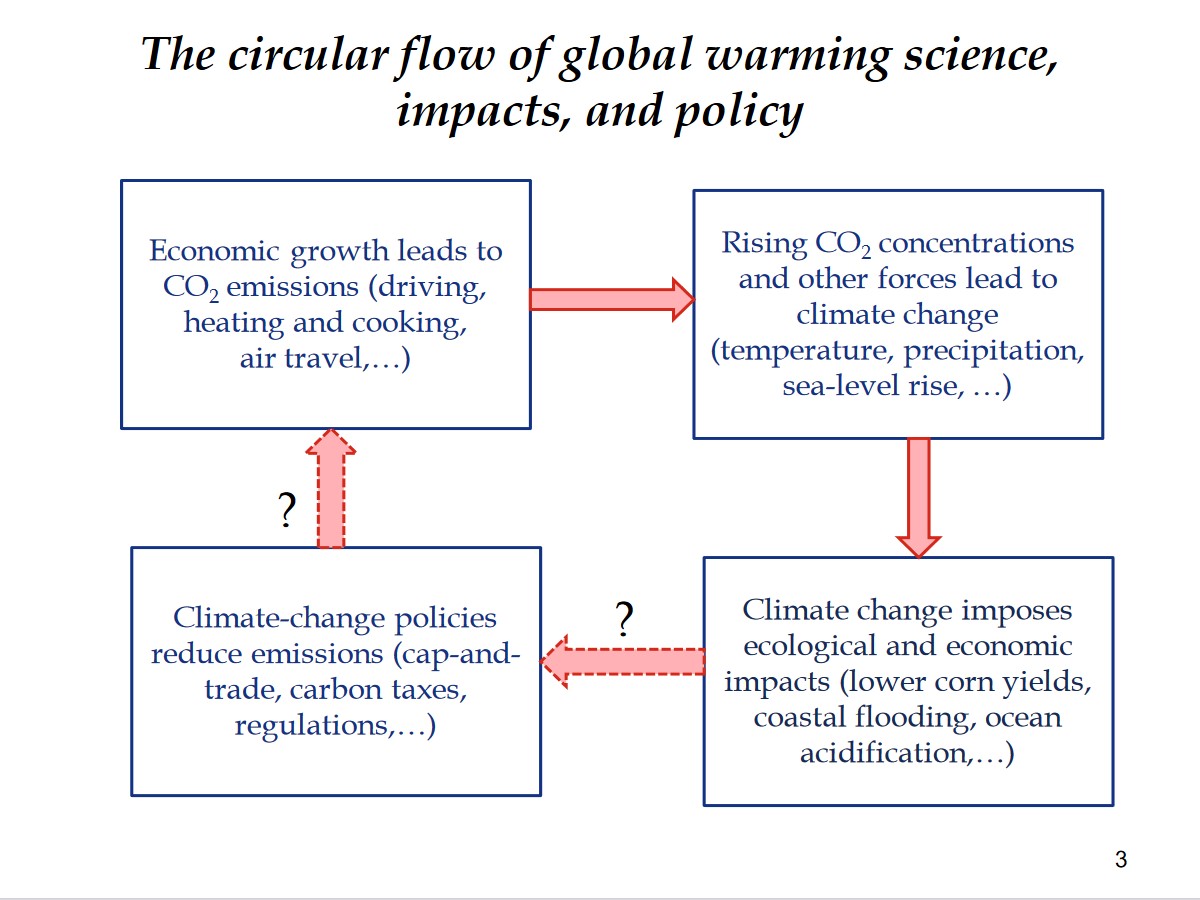

Main Cause of Global Warming

Consensus from Earth Science

- burning of fossil fuels (oil, gas, ) -> emission Carbon Dioxyde CO2

- on of the main Greenhouse gases

- GHG accumulate in the atomosphere

- warms land and oceans

- more evaporation -> feedback effects

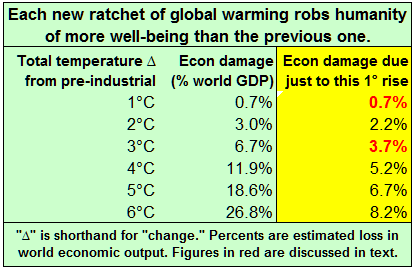

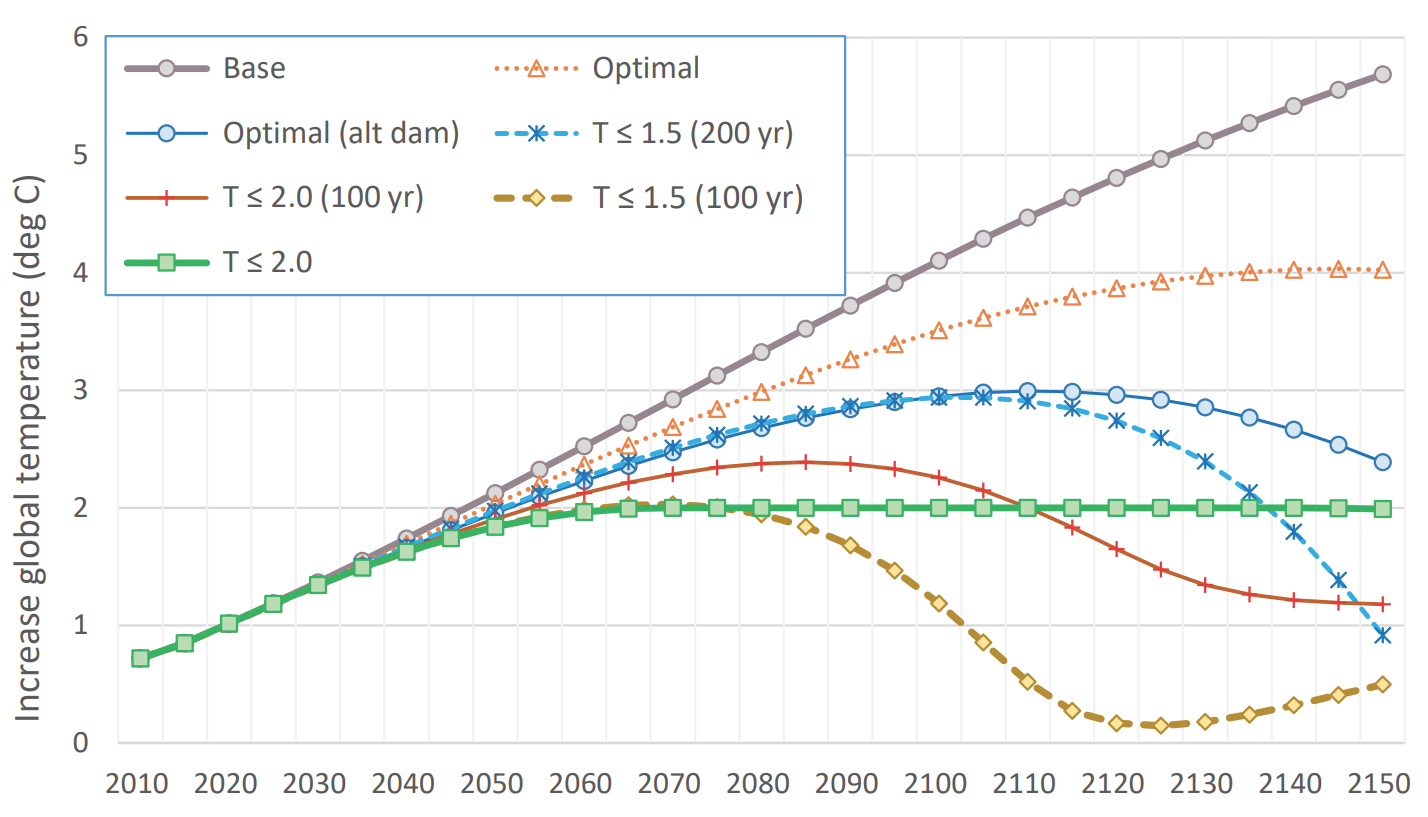

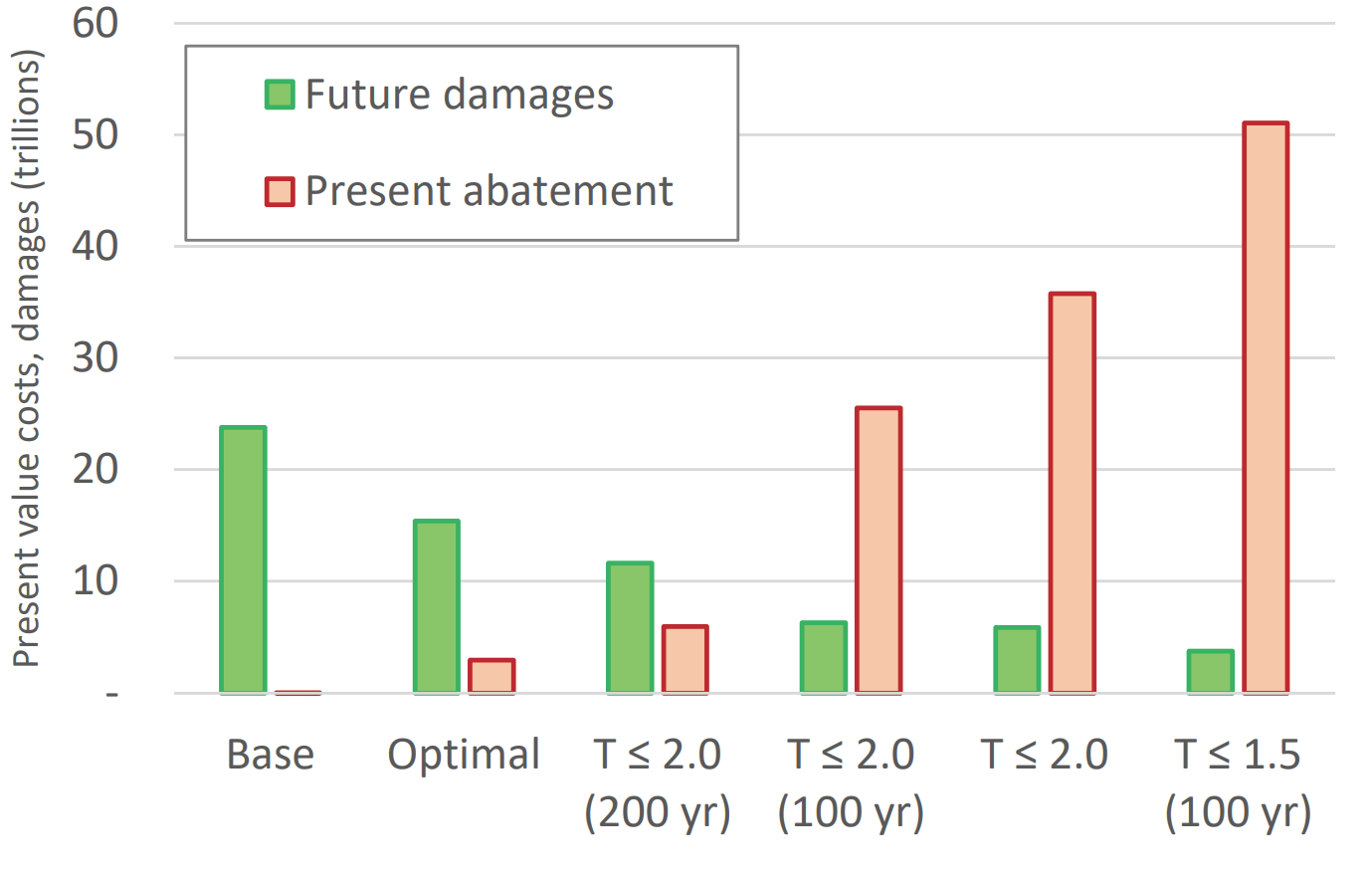

Social cost of carbon

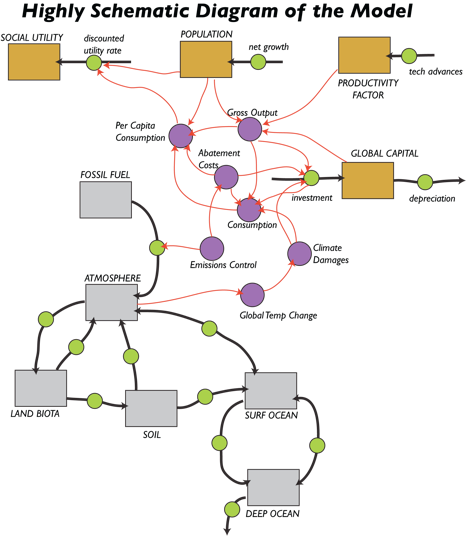

Despite raising some legitimate doubts about optimal carbon policy IAM models yield estimates for the price of carbon which are used as a basis for policy discussions.