Multiple Regression

Data-Based Economics, ESCP, 2025-2026

2026-01-21

The problem

Remember dataset from last time

| type | income | education | prestige | |

|---|---|---|---|---|

| accountant | prof | 62 | 86 | 82 |

| pilot | prof | 72 | 76 | 83 |

| architect | prof | 75 | 92 | 90 |

| author | prof | 55 | 90 | 76 |

| chemist | prof | 64 | 86 | 90 |

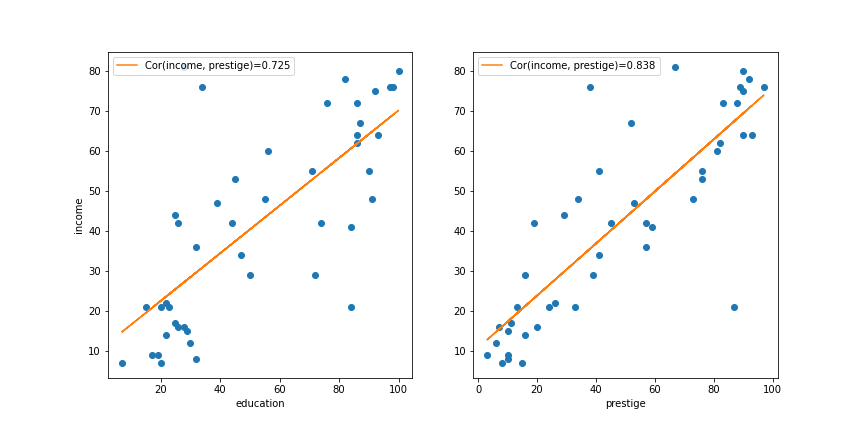

- Last week we “ran” a linear regression: \(y = \alpha + \beta x\). Result: \[\text{income} = xx + 0.72 \text{education}\]

- Should we have looked at “prestige” instead ? \[\text{income} = xx + 0.83 \text{prestige}\]

- Which one is better?

Prestige or Education

- if the goal is to predict: the one with higher explained variance

prestigehas higher \(R^2\) (\(0.83^2\))

- unless we are interested in the effect of education

Multiple regression

- What about using both?

- 2 variables model: \[\text{income} = \alpha + \beta_1 \text{education} + \beta_2 \text{prestige}\]

- will probably improve prediction power (explained variance)

- \(\beta_1\) might not be meaningful on its own anymore (education and prestige are correlated)

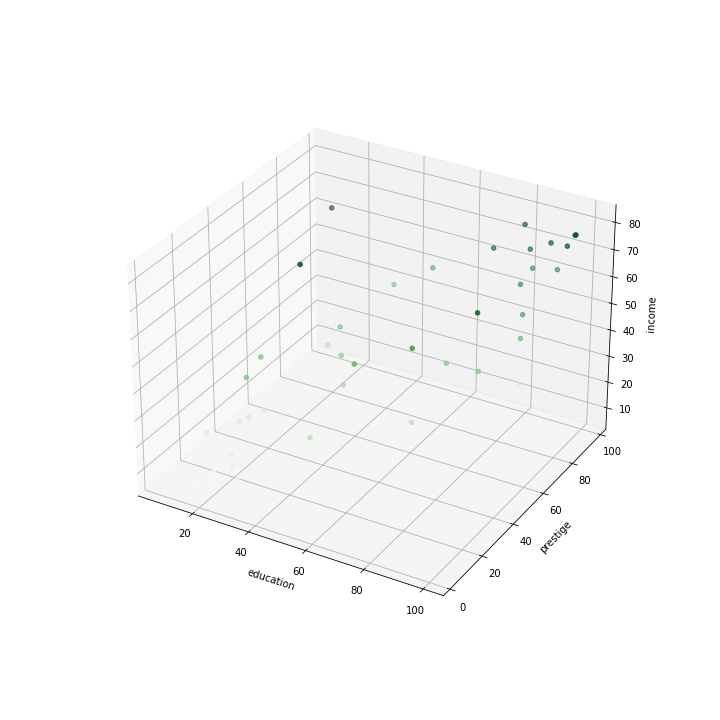

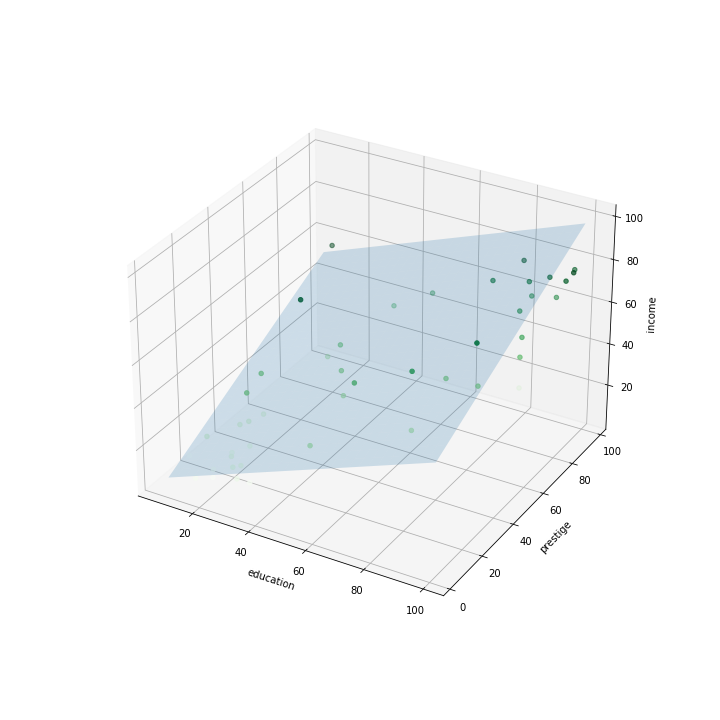

Fitting a model

Now we are trying to fit a plane to a cloud of points.

Minimization Criterium

- Take all observations: \((\text{income}_n,\text{education}_n,\text{prestige}_n)_{n\in[0,N]}\)

- Objective: sum of squares \[ L(\alpha, \beta_1, \beta_2) = \sum_i \left( \underbrace{ \alpha + \beta_1 \text{education}_n + \beta_2 \text{prestige}_n - \text{income}_n }_{e_n=\text{prediction error} }\right)^2 \]

- Minimize loss function in \(\alpha\), \(\beta_1\), \(\beta_2\)

- Again, we can perform numerical optimization (machine learning approach)

- … but there is an explicit formula

Ordinary Least Square

\[Y = \begin{bmatrix} \text{income}_1 \\\\ \vdots \\\\ \text{income}_N \end{bmatrix}\] \[X = \begin{bmatrix} 1 & \text{education}_1 & \text{prestige}_1 \\\\ \vdots & \vdots & \vdots \\\\ 1 &\text{education}_N & \text{prestige}_N \end{bmatrix}\]

- Matrix Version (look for \(B = \left( \alpha, \beta_1 , \beta_2 \right)\)): \[Y = X B + E\]

- Note that constant can be interpreted as a “variable”

- Loss function \[L(A,B) = (Y - X B)' (Y - X B)\]

- Result of minimization \(\min_{(A,B)} L(A,B)\) : \[\begin{bmatrix}\alpha & \beta_1 & \beta_2 \end{bmatrix} = (X'X)^{-1} X' Y \]

Solution

- Result: \[\text{income} = 10.43 + 0.03 \times \text{education} + 0.62 \times \text{prestige}\]

- Questions:

- is it a better regression than the other?

- is the coefficient in front of

educationsignificant? - how do we interpret it?

- can we build confidence intervals?

Explained Variance

Explained Variance

As in the 1d case we can compare: - the variability of the model predictions (\(MSS\)) - the variance of the data (\(TSS\), T for total)

Coefficient of determination (same formula):

\[R^2 = \frac{MSS}{TSS}\]

Or:

\[R^2 = 1-\frac{RSS}{SST}\]

where \(RSS\) is the non explained variance

Adjusted R squared

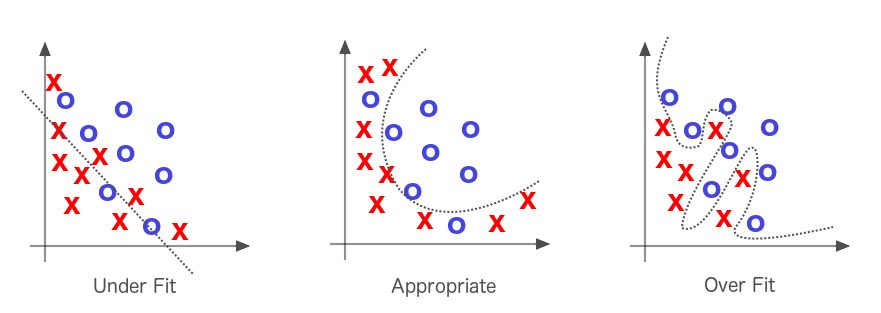

Fact:

- adding more regressors always improve \(R^2\)

- why not throw everything in? (kitchen sink regressions)

- two many regressors: overfitting the data

Penalise additional regressors: adjusted R^2

\[R^2_{adj} = 1-(1-R^2)\frac{N-1}{N-p-1}\]

Where:

- \(N\): number of observations

- \(p\) number of variables

In our example:

| Regression | \(R^2\) | \(R^2_{adj}\) |

|---|---|---|

| education | 0.525 | 0.514 |

| prestige | 0.702 | 0.695 |

| education + prestige | 0.7022 | 0.688 |

Interpretation and variable change

Making a regression with statsmodels

We use a special API inspired by R:

Performing a regression

- Running a regression with

statsmodels

model = smf.ols('income ~ education', df) # model

res = model.fit() # perform the regression

res.describe()- ‘income ~ education’ is the model formula

OLS Regression Results

==============================================================================

Dep. Variable: income R-squared: 0.525

Model: OLS Adj. R-squared: 0.514

Method: Least Squares F-statistic: 47.51

Date: Tue, 02 Feb 2021 Prob (F-statistic): 1.84e-08

Time: 05:21:25 Log-Likelihood: -190.42

No. Observations: 45 AIC: 384.8

Df Residuals: 43 BIC: 388.5

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

==============================================================================

Intercept 10.6035 5.198 2.040 0.048 0.120 21.087

education 0.5949 0.086 6.893 0.000 0.421 0.769

==============================================================================

Omnibus: 9.841 Durbin-Watson: 1.736

Prob(Omnibus): 0.007 Jarque-Bera (JB): 10.609

Skew: 0.776 Prob(JB): 0.00497

Kurtosis: 4.802 Cond. No. 123.

==============================================================================Formula mini-language

- With

statsmodelsformulas, can be supplied with R-style syntax - Examples:

| Formula | Model |

|---|---|

income ~ education |

\(\text{income}_i = \alpha + \beta \text{education}_i\) |

income ~ prestige |

\(\text{income}_i = \alpha + \beta \text{prestige}_i\) |

income ~ prestige - 1 |

\(\text{income}_i = \beta \text{prestige}_i\) (no intercept) |

income ~ education + prestige |

\(\text{income}_i = \alpha + \beta_1 \text{education}_i + \beta_2 \text{prestige}_i\) |

Formula mini-language

- One can use formulas to apply transformations to variables

| Formula | Model |

|---|---|

log(P) ~ log(M) + log(Y) |

\(\log(P_i) = \alpha + \alpha_1 \log(M_i) + \alpha_2 \log(Y_i)\) (log-log) |

log(Y) ~ i |

\(\log(P_i) = \alpha + i_i\) (semi-logs) |

- This is useful if the true relationship is nonlinear

- Also useful, to interpret the coefficients

Coefficients interpetation

Example:

(

police_spendingandprevention_policiesin million dollars) \[\text{number_or_crimes} = 0.005\% - 0.001 \text{pol_spend} - 0.005 \text{prev_pol} + 0.002 \text{population density}\]reads: when holding other variables constant a 0.1 million increase in police spending reduces crime rate by 0.001%

Iinterpretation?

- problematic because variables have different units

- we can say that prevention policies are more efficient than police spending ceteris paribus

Take logs: \[\log(\text{number_or_crimes}) = 0.005\% - 0.15 \log(\text{pol_spend}) - 0.4 \log(\text{prev_pol}) + 0.2 \log(\text{population density})\]

- now we have an estimate of elasticities

- a \(1\%\) increase in police spending leads to a \(0.15\%\) decrease in the number of crimes

Statistical Inference

Hypotheses

-

Recall what we do:

- we have the data \(X,Y\)

- we choose a model: \[ Y = \alpha + X \beta \]

- from the data we compute estimates: \[\hat{\beta} = (X'X)^{-1} X' Y \] \[\hat{\alpha} = Y- X \beta \]

- estimates are a precise function of data

- exact formula not important here

We need some hypotheses on the data generation process:

- \(Y = X \beta + \epsilon\)

- \(\mathbb{E}\left[ \epsilon \right] = 0\)

- \(\epsilon\) multivariate normal with covariance matrix \(\sigma^2 I_n\)

- \(\forall i, \sigma(\epsilon_i) = \sigma\)

- \(\forall i,j, cov(\epsilon_i, \epsilon_j) = 0\)

Under these hypotheses:

- \(\hat{\beta}\) is an unbiased estimate of true parameter \(\beta\)

- i.e. \(\mathbb{E} [\hat{\beta}] = \beta\)

- one can prove \(Var(\hat{\beta}) = \sigma^2 I_n\)

- \(\sigma\) can be estimated by \(\hat{\sigma}=S\frac{\sum_i (y_i-{pred}_i)^2}{N-p}\)

- \(N-p\): degrees of freedoms

- one can estimate: \(\sigma(\hat{\beta_k})\)

- it is the \(i\)-th diagonal element of \(\hat{\sigma}^2 X'X\)

Is the regression significant?

- Approach is very similar to the one-dimensional case

Fisher Criterium (F-test)

- \(H0\): all coeficients are 0

- i.e. true model is \(y=\alpha + \epsilon\)

- \(H1\): some coefficients are not 0

Statistics: \[F=\frac{MSR}{MSE}\] (same as 1d)

- \(MSR\): mean-squared error of constant model

- \(MSE\): mean-squared error of full model

Under:

- the model assumptions about the data generation process

- the H0 hypothesis

… the distribution of \(F\) is known

It is remarkable that it doesn’t depend on \(\sigma\) !

One can produce a p-value.

- probability to obtain this statistics given hypothesis H0

- if very low, H0 is rejected

Is each coefficient significant ?

Student Test

Given a coefficient \(\beta_k\):

- \(H0\): true coefficient is 0

- \(H1\): true coefficient is not zero

Statistics (student-t): \[t = \frac{\hat{\beta_k}}{\hat{\sigma}(\hat{\beta_k})}\]

- where \(\hat{\sigma}(\beta_k)\) is \(i\)-th diagonal element of \(\hat{\sigma}^2 X'X\)

- it compares the estimated value of a coefficient to its estimated standard deviation

Under the inference hypotheses, distribution of \(t\) is known.

- it is a student distribution

Procedure:

- Compute \(t\). Check acceptance threshold \(t*\) at probability \(\alpha\) (ex 5%)

- Coefficient is significant with probability \(1-\alpha\) if \(t>t*\)

Or just look at the p-value:

- probability that \(t\) would be as high as it is, assuming \(H0\)

Confidence intervals

Same as in the 1d case.

- Take estimate \(\color{red}{\beta_i}\) with an estimate of its standard deviation \(\color{red}{\hat{\sigma}(\beta_i)}\)

- Compute student \(\color{red}{t^{\star}}\) at \(\color{red}{\alpha}\) confidence level (ex: \(\alpha=5\\%\)) such that:

- \(P(|t|>t^{\star})<\alpha\)

Produce confidence intervals at \(\alpha\) confidence level:

- \([\color{red}{\beta_i} - t^{\star} \color{red}{\hat{\sigma}(\beta_i)}, \color{red}{\beta_i} + t^{\star} \color{red}{\hat{\sigma}(\beta_i)}]\)

Interpretation:

- for a given confidence interval at confidence level \(\alpha\)…

- the probability that our coefficient was obtained, if the true coefficient were outside of it, is smaller than \(\alpha\)

Other tests

- The tests seen so far rely on strong statistical assumptions (normality, homoscedasticity, etc..)

- Some tests can be used to test these assumptions:

- Jarque-Bera: is the distribution of data truly normal

- Durbin-Watson: are residuals autocorrelated (makes sense for time-series)

- …

- In case assumptions are not met…

- … still possible to do econometrics

- … but beyond the scope of this course

Variable selection

Variable selection

- I’ve got plenty of data:

- \(y\): gdp

- \(x_1\): investment

- \(x_2\): inflation

- \(x_3\): education

- \(x_4\): unemployment

- …

- Many possible regressions:

- \(y = α + \beta_1 x_1\)

- \(y = α + \beta_2 x_2 + \beta_3 x_4\)

- …

- Which one do I choose ?

- putting everything together is not an option (kitchen sink regression)

Not enough coefficients

Suppose you run a regression: \[y = \alpha + \beta_1 x_1 + \epsilon\] and are genuinely interested in coefficient \(\beta_1\)

But unknowingly to you, the actual model is \[y = \alpha + \beta_1 x_1 + \beta_2 x_2 + \eta\]

The residual \(y - \alpha - \beta_1 x_1\) is not white noise

- specification hypotheses are violated

- estimated \(\hat{\beta_1}\) will have a bias (omitted variable bias)

- to correct the bias we add \(x_2\)

- even though we are not interested in \(x_2\) by itself

- we control for \(x_2\)

Example

- Suppose I want to check Okun’s law. I consider the following model: \[\text{gdp_growth} = \alpha + \beta \times \text{unemployment}\]

- I obtain: \[\text{gdp_growth} = 0.01 - 0.1 \times \text{unemployment} + e_i\]

- Then I inspect visually the residuals: not normal at all!

- Conclusion: my regression is misspecified, \(0.1\) is a biased (useless) estimate

- I need to control for additional variables. For instance: \[\text{gdp_growth} = \alpha + \beta_1 \text{unemployment} + \beta_2 \text{interest rate}\]

- Until the residuals are actually white noise

Colinear regressors

- What happens if two regressors are (almost) colinear? \[y = \alpha + \beta_1 x_1 + \beta_2 x_2\] where \(x_2 = \kappa x_1\)

- Intuitively: parameters are not unique

- if \(y = \alpha + \beta_1 x_1\) is the right model…

- then \(y = \alpha + \beta_1 \lambda x_1 + \beta_2 (1-\lambda) \frac{1}{\kappa} x_2\) is exactly as good…

- Mathematically: \((X'X)\) is not invertible.

- When regressors are almost colinear, coefficients can have a lot of variability.

- Test:

- correlation statistics

- correlation plot

Choosing regressors

\[y = \alpha + \beta_1 x_1 + ... \beta_n x_n\]

Which regressors to choose ?

Method 1 : remove coefficients with lowest t (less significant) to maximize adjusted R-squared

- remove regressors with lowest t

- not the one you are interested in ;)

- regress again

- see if adjusted \(R^2\) is decreasing

- if so continue

- otherwise cancel last step and stop

Method 2 : choose combination to maximize Akaike Information Criterium

- AIC: \(p - log(L)\)

- \(L\) is likelihood

- computed by all good econometric softwares