Introduction

Advanced Macro: Numerical Methods (MIE37)

Pablo Winant

2025-02-06

Communication for this Course

- Github repository for the course: https://github.com/albop/mie37

- Join on Zulip : we’ll communicate in the

mie37room- you’re welcome to ask questions and answer other’s questions (nicely)

- outside of the course hours, I’ll answer when I can

- Formal or infrequent communication:

pwinant@escp.euwith subject starting by[mie37]

Assignments and Final Exam

- Hands-on tutorial started in class must be (reasonably) completed by Wednesday night.

- There will be two special assignments with 14 days to complete each of them.

- Groupwork is OK.

- Final Exam will take place in the latest session.

- It will consists of a few simple programming questions and a small model to solve yourself.

- Final Grade will weight everything.

Other sources of information

- Course is mostly self-contained for its Math and Econ aspects.

- Books:

- Economic Dynamics: Theory and Computation by John Stahurski

- Computational Economics by Miranda & Fackler

- Recursive macreconomic theory by Lars Ljungqvist & Tom Sargent

- Online:

- … and all the Julia material

About me

- A computational economist

- Formerly Worked in institutions (IMF, BOE)

- Now at ESCP and CREST/Polytechnique

- Research on models about:

- Inequality (heterogeneity)

- International Finance

- Monetary Policy

- Artificial Intelligence

- Involved in several opensource projects (Dolo, QuantEcon, ARK)

Content of the course

- Computational Economics is made of:

- Applied Math (theory)

- Programming (techniques)

- Economic Modeling (expertise)

- We’ll alternate between the three topics

- with a stronger than usual emphasis on Programming skills

Math

- We won’t be using very advanced math

- linear algebra, Banach spaces, a bit of probabilities

- working knowledge is fine

- (almost) no proofs

- but in a context where advanced math is an option…

- functional spaces…

- applied math: essentially describes the algorithms and their validity/convergence properties

Models

- See a variety of models:

- Static Market Determination (Computational General Equilibrium: CGE)

- Dynamic Optimization (continous or discrete)

- Linear Rational Expectations Models

- Dynamic Stochastic General Equilibrium models (DSGE)

- Heterogenous Agents Models

- In discrete time

- to avoid discretization schemes and stochastic calculus

- Usually a model is specified by equations and some parameter values:

- no closed form, most of the time

- goal is to “solve” the model to study properties of its solutions

Models (2)

- random examples of questions we can analyse numerically:

- which sectors should receive more help during the coronavirus (CGE)?

- when is it time to replace a machine? how much water should be extracted? how much should be stored? (dynamic programming)

- what kind of shock drives the business cycles? (DSGE models)

- is a Central Bank able to commit to intervene in the markets? (time inconsistency)

Why economics is not Physics (1)

- Easy!: you just swap particles for people, and simulate (or solve an IVP problem)

- NO: Not only local interactions: economic agents interact in many ways, including through markets

- All agents/prices must be solved at the same time

Why economics is not Physics (2)

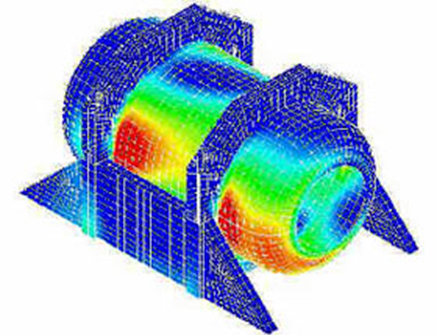

FEM

- Easy!: it’s a differential equation with boundary values (BVP)

- NO: agents think, they are forward looking and respond to other agents’ (possibly future) decisions

What makes the life of computational economists hard:

- Agents are rationnal, they should consider all possible outcomes and all decisions (and those of others…) in the future to make a decision today

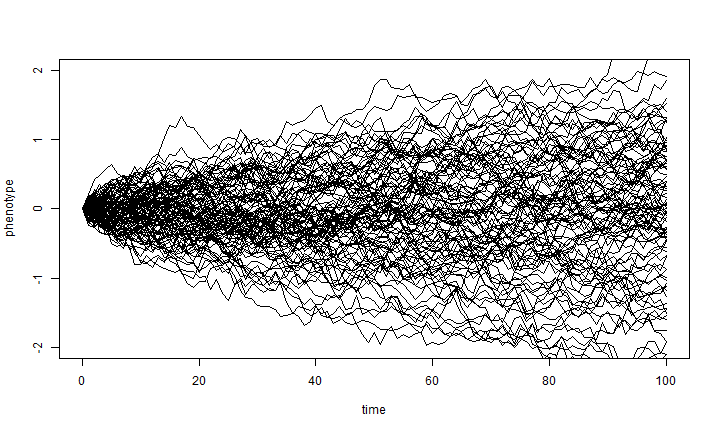

![bm]()

- Very complex problem: curse of dimensionality when more than a few variables

- Wait, that’s crazy! People are not that smart, let’s make simplifying assumptions about their behaviour

- agent based approach

- methodological issues: too many possible predictions, too many parameters

Why should you learn to program ?

- Econometricians, modellers, data scientists, spend a lot of time writing code

- and do it inefficiently…

- Programming efficiently requires awareness of

- certain basic concepts: (types, control flow, functions, objects)

- some tools (programming language, code versioning, command line)

- which are never taught…

- And yet they are very easy to learn

- anyone can become an expert !

Now is the right time !

- A lot of demand everywhere for skilled programmers.

- Many faculties are introducing formal programming courses (for economists)

- NYU, Penn, MIT (see thinking computationnally

- Summer Bootcamps

- New applications are even more code-intensive than before:

- data science

- machine learning

- modeling

Do it in the open !

- Many excellent online resources:

- Software Carpentry

- QuantEcon from Tom Sargent and John Stachurski

- Julia manuals/tutorials

- Opensource community is very welcoming:

- ask on mailing lists or online chats (Julia users, quantecon, dynare, …)

- open issues (for instance against Dolo https://github.com/EconForge/Dolo.jl/issues

- participating is also a great occasion to learn

Setup

- Plan A: use your own laptop. You will need:

- Julia 1.11.x (install using JuliaUp)

- visual studio code

- julia extension to VSCode

- git

- Plan B: use the mybinder links from the courses repository.